HydraDX - fouzantanveer's results

HydraDX Omnipool - An Ocean of Liquidity for Polkadot Trade an abundance of assets in a single pool. The HydraDX Omnipool is efficient, sustainable and trustless.

General Information

Platform: Code4rena

Start Date: 02/02/2024

Pot Size: $100,000 USDC

Total HM: 11

Participants: 27

Period: 28 days

Judge: Lambda

Total Solo HM: 4

Id: 327

League:

Findings Distribution

Researcher Performance

Rank: 24/27

Findings: 1

Award: $118.22

🌟 Selected for report: 0

🚀 Solo Findings: 0

Findings Information

🌟 Selected for report: hunter_w3b

Also found by: 0xSmartContract, Franfran, TheSchnilch, ZanyBonzy, carrotsmuggler, castle_chain, fouzantanveer, kaveyjoe, popeye, yongskiws

Labels

Awards

118.2201 USDC - $118.22

External Links

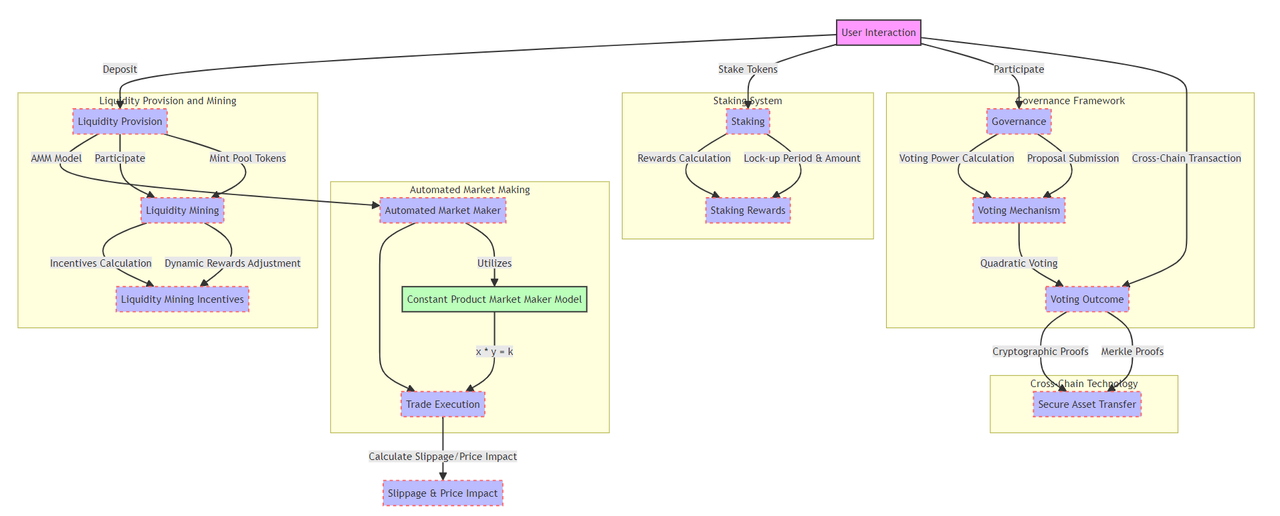

Conceptual Overview

HydraDX is a decentralized finance (DeFi) ecosystem designed to streamline cross-chain liquidity and trading, powered by an Automated Market Maker (AMM) model. Initially, users deposit their tokens into HydraDX's liquidity pools, which support a multitude of assets across different blockchains, effectively becoming liquidity providers. This foundational step enables seamless asset exchanges and reduces liquidity fragmentation across the DeFi landscape. Following this, users can engage with the platform's AMM to execute trades against these liquidity pools, benefiting from algorithmically adjusted prices that minimize slippage, even during volatile market conditions. To safeguard these transactions, HydraDX incorporates mechanisms for slippage protection, allowing users to set their own tolerance levels to ensure trades are executed within desired price ranges. Beyond trading, the platform offers a multi-asset staking feature, where users can stake a variety of tokens to earn rewards, thereby securing the network while diversifying their investment portfolio. Central to HydraDX's ethos is its decentralized governance system, granting token holders the power to propose, vote on, and implement changes within the ecosystem. This sequential interaction—starting from token deposit, moving through trading and staking, and culminating in governance participation—crafts a comprehensive DeFi platform that not only facilitates efficient and secure asset exchange but also fosters a collaborative and adaptive community-driven environment.

Technical Overview

Diving deeper into the technical fabric of the HydraDX project, we'll explore the underlying logics and mechanisms that empower its distinct functionalities.

Token Deposits

The initial interaction, involving token deposits, is facilitated through smart contracts that interface with ERC20 standards. The logic here involves calling the approve method on the ERC20 token contract, followed by the depositToken method on the HydraDX contract, which checks the approval and then transfers the tokens from the user's address to the contract. This double-call mechanism is a standard DeFi pattern, ensuring that tokens are securely moved with explicit user permission, mitigating unauthorized transfers.

Liquidity Provision

For liquidity provision, the LiquidityPoolManager contract employs an algorithm to calculate the liquidity token amount to mint based on the deposited asset's value and the current pool's size. This calculation typically follows the Constant Product Formula (x*y=k), ensuring that the pool remains balanced and the price impact of trades is minimized. The minting of liquidity tokens as a receipt for the user's contribution is crucial for tracking ownership and distribution of transaction fees and rewards.

When users provide liquidity to a pool, they are minted pool tokens that represent their share of the pool. The mathematical logic for determining the amount of pool tokens to mint is based on the proportion of the liquidity the user is adding to the pool. If a user adds a value (v) to a pool with a total value (V), the number of minted pool tokens (m) is usually proportional to (v/V), ensuring that the user's share of the pool reflects the added liquidity's value. This calculation encourages equitable distribution of fees and rewards generated by the pool's trading activity.

Automated Market Maker (AMM) Trading

The core logic of AMM trading in HydraDX lies in the constant product formula, which maintains product consistency (x*y=k) across trades, regardless of the pool size. This formula determines the output amount for a given input, ensuring liquidity and price stability. The contract dynamically adjusts prices based on supply and demand, with slippage and transaction fees accounted for in the trade execution. This mechanism allows for decentralized and automated trading without the need for traditional market makers.

Staking for Rewards

Staking logic involves locking liquidity tokens in the StakingRewards contract to earn rewards. The contract calculates rewards based on the amount of time and the quantity of tokens staked, using a distribution rate predefined by the protocol governance. This mechanism incentivizes users to contribute to liquidity and network security, distributing rewards in a way that promotes long-term participation and stability.

Governance Participation

Governance is powered by a smart contract that facilitates proposal creation, voting, and execution. The logic here involves token-based voting, where the weight of a vote is proportional to the number of governance tokens held. This democratic process ensures that proposals with the highest stakeholder support are implemented, reflecting the community's consensus and promoting decentralized decision-making.

Cross-Chain Operations

The cross-chain functionality leverages bridge contracts that monitor deposits on one chain and issue equivalent tokens on another, following verification processes like Merkle proofs to ensure transaction legitimacy. This logic enables seamless asset transfer across different blockchains, expanding HydraDX's interoperability and utility in a multi-chain ecosystem.

Liquidity Mining Programs

Liquidity mining involves distributing additional rewards to liquidity providers, calculated based on their share of the pool and the time their assets are locked. The contract employs algorithms to adjust reward rates dynamically, incentivizing participation when liquidity is needed and scaling back issuance to prevent inflation when goals are met. This balancing act encourages consistent liquidity provision, directly contributing to the platform's overall health and efficiency.

Architecture of the project

Core Modules and Their Connections

-

stableswap:

- Module Role: Central to the project, focusing on stablecoin swaps with minimal slippage.

- Logic and Interaction: Implements the logic for curve-based stablecoin trading, ensuring efficient pricing and liquidity usage. This module is crucial for maintaining stable trading mechanisms and minimizing impermanent loss, which is a common issue in traditional AMM-based DEXes.

-

math/src/stableswap:

- Module Role: Supports the

stableswapmodule by providing mathematical models for calculating swap prices and liquidity provisions. - Logic and Interaction: Contains the algorithms for dynamically adjusting swap curves based on the liquidity pool's state, which directly influences the pricing mechanism. It's likely where innovative approaches to managing slippage and impermanent loss are coded.

- Module Role: Supports the

-

ema-oracle:

- Module Role: Provides price feeds through Exponential Moving Averages (EMAs) for assets, crucial for accurate pricing in the DEX.

- Logic and Interaction: Interacts with the trading and liquidity modules to update asset prices in real-time, ensuring the swap mechanism has access to current market data. This module is essential for mitigating risks associated with price volatility.

-

circuit-breaker:

- Module Role: Acts as a safety mechanism to prevent excessive market manipulation or volatility by limiting the amount of liquidity that can be added or removed within a certain timeframe.

- Logic and Interaction: Directly influences the liquidity management strategy by setting thresholds that control how liquidity can be interacted with, ensuring market stability and protecting liquidity providers.

Logic and Functionality Analysis

- The

stableswapmodule likely contains smart contracts or pallets that define the core logic for swapping assets within the DEX. This would include functions for adding/removing liquidity, executing trades, and calculating prices based on the liquidity pool's current state. - The mathematical models within the

math/src/stableswapdirectory are essential for the DEX's ability to offer stable swaps with minimal slippage. This includes algorithms for curve adjustment, price calculation, and potentially mechanisms for reducing impermanent loss. - The

ema-oraclemodule provides a decentralized way to fetch and calculate asset prices, which are crucial for the swap mechanism to function accurately. This would involve fetching external data, calculating EMAs, and updating asset prices within the DEX. - The

circuit-breakermodule introduces a unique mechanism to protect the DEX and its users from extreme market conditions or manipulation by temporarily halting trading or liquidity movements that exceed predefined thresholds.

Mathematical Logic

Liquidity Adjustments

Adding Liquidity

When adding liquidity to the pool, the number of shares $S_{\text{new}}$ minted for the liquidity provider is determined based on the proportion of the liquidity $L_{\text{add}}$ added relative to the existing total liquidity $L_{\text{total}}$ before the addition:

where:

-

For the amount of liquidity added by the provider:

-

For the total liquidity in the pool before adding:

-

For the total shares in the pool before adding:

Removing Liquidity

When removing liquidity, the amount of assets $A_{\text{remove}}$ returned to the provider is based on the proportion of the shares $S_{\text{burn}}$ they are burning:

where:

- $S_{\text{burn}}$ is the number of shares the provider is burning,

- $S_{\text{total}}$ is the total shares in the pool,

- $A_{\text{total}}$ is the total assets in the pool.

Trade Execution

Price Impact and Trade Execution

The price impact of a trade and the resulting asset amounts are often determined using functions derived from the constant product formula, $x \times y = k$, in traditional AMMs or other formulas depending on the specific AMM model. For a trade that exchanges asset $X$ for asset $Y$, the formula adjusts to account for the input amount $X_{\text{in}}$, the liquidity pool's reserves $X_{\text{reserve}}$ and $Y_{\text{reserve}}$, and applied fees.

The new reserve for $X$ after the trade $X'_{\text{reserve}}$ can be determined by adding the input amount to the current reserve, adjusting for fees:

The output amount $Y_{\text{out}}$ can then be calculated based on the constant product formula or another liquidity model, ensuring the invariant holds after accounting for the input amount and fees.

Fee Application

Fees are a crucial part of the trade execution process, providing compensation to liquidity providers and supporting the sustainability of the pool. The fee for a trade can be calculated as a percentage of the trade amount:

This fee is typically added to the pool's reserves, indirectly benefiting liquidity providers by increasing the total value held within the pool.

Conclusion

The mathematical expressions outlined above provide a foundational understanding of the operations within HydraDX's Omnipool...

Inter-module Communication and Logic Flow

One of the architectural highlights is how seamlessly modules communicate and interlink, creating a robust and flexible ecosystem. For instance, the swap.rs and pool.rs modules are central to the project's functionality, facilitating asset swaps through liquidity pools. The underlying logic in swap.rs is designed to calculate prices and execute trades with minimal impact on market prices, leveraging liquidity from pool.rs. This interaction is crucial for maintaining market stability and providing users with fair, efficient trading opportunities.

The governance mechanism, encapsulated within governance.rs, showcases a decentralized model for decision-making, which is critical for the adaptability and longevity of the platform. This module's logic allows for proposals, voting, and implementation of changes directly by the community, ensuring that the platform remains responsive to its users' needs and the evolving DeFi landscape. The technical implementation here is a lesson in creating flexible, user-driven platforms that can evolve without centralized oversight.

Critical Analysis of Functionality Logic

A critical analysis of the project's logic reveals a strong emphasis on security and stability, exemplified by the inclusion of a circuit breaker mechanism (circuit-breaker/lib.rs). This feature is a proactive measure against market manipulation and extreme volatility, showcasing the project's foresight in incorporating safeguards that protect users and ensure the integrity of the platform.

Furthermore, the staking.rs and liquidity_mining.rs modules embody the project's innovative approach to incentivizing participation. The logic within these modules is designed to balance rewards with network security and liquidity provision, creating a sustainable ecosystem where users are motivated to contribute to the platform's health and growth.

Interaction of core file

The lib.rs file from the HydraDX Omnipool pallet is central to the Omnipool's functionality, interacting extensively with various components both within the pallet and external modules to accomplish its objectives. Here's an analysis of its interactions and how it ties into the broader ecosystem:

Interactions Within the Omnipool Pallet

Asset and Liquidity Management

- Assets and Positions: The core file interacts with its own storage items like

AssetsandPositionsto manage the state of each asset in the Omnipool and the liquidity positions held by users. Functions likeadd_token,add_liquidity, andremove_liquiditymodify these storage items directly to reflect changes in liquidity and asset status.

Mathematical Operations

- Mathematical Libraries: For price calculations, liquidity adjustments, and trade execution, the Omnipool relies on mathematical models. The file calls into the

hydra_dx_mathlibrary for functions likecalculate_add_liquidity_state_changes,calculate_remove_liquidity_state_changes, and trade price calculations, ensuring that all operations are grounded in solid mathematical principles.

Interactions with External Pallets and Modules

Currency and Asset Management

- MultiCurrency (from

orml_traits): The Omnipool interacts with a generalized multi-currency interface for asset transfers, deposits, and withdrawals. This is crucial for the Omnipool's functionality, as it allows the seamless exchange of different assets within the pool.

NFTs for Liquidity Positions

- NFTHandler: Liquidity positions in the Omnipool are represented as NFTs. The pallet interacts with an NFT module compliant with

frame_supporttraits for creating, minting, and burning NFTs, linking liquidity positions directly to unique, tradable assets.

Hooks and Callbacks

Omnipool Hooks

- OmnipoolHooks: For extensibility, the Omnipool implements hooks that are called during key operations like liquidity changes and trades. These hooks allow for additional logic to be executed, such as updating on-chain oracles or interacting with other pallets like a circuit breaker or fee distribution mechanisms.

Price and Safety Checks

- PriceBarrier and ExternalPriceOracle: To protect against price manipulation and ensure the safety of trades, the Omnipool interacts with price oracles. It validates operations against external price feeds and internal price barriers, adjusting operations as necessary to maintain market integrity.

Cross-Pallet Interactions for Governance and Technical Operations

- AuthorityOrigin and TechnicalOrigin: Certain operations within the Omnipool, like setting asset tradable states or managing protocol liquidity, are restricted to governance or technical administrators. The pallet enforces these permissions through specific origin checks, ensuring that only authorized operations are executed.

Summary

The lib.rs file serves as the heart of the HydraDX Omnipool, coordinating complex interactions between internal logic, external modules, and cross-pallet functionalities. Through these interactions, it supports a wide range of operations from liquidity provision and trading to governance actions, all while maintaining security, efficiency, and user trust. These mechanisms collectively ensure the Omnipool's capability to function as a dynamic, secure, and user-centric decentralized exchange platform.

Time spent:

14 hours

#0 - c4-pre-sort

2024-03-03T18:27:07Z

0xRobocop marked the issue as sufficient quality report

#1 - c4-judge

2024-03-08T19:08:12Z

OpenCoreCH marked the issue as grade-b