NextGen - Fulum's results

Advanced smart contracts for launching generative art projects on Ethereum.

General Information

Platform: Code4rena

Start Date: 30/10/2023

Pot Size: $49,250 USDC

Total HM: 14

Participants: 243

Period: 14 days

Judge: 0xsomeone

Id: 302

League: ETH

Findings Distribution

Researcher Performance

Rank: 56/243

Findings: 4

Award: $133.68

🌟 Selected for report: 1

🚀 Solo Findings: 0

Findings Information

🌟 Selected for report: smiling_heretic

Also found by: 00decree, 00xSEV, 0x180db, 0x3b, 0x656c68616a, 0xAadi, 0xAleko, 0xAsen, 0xDetermination, 0xJuda, 0xMAKEOUTHILL, 0xMango, 0xMosh, 0xSwahili, 0x_6a70, 0xarno, 0xgrbr, 0xpiken, 0xsagetony, 3th, 8olidity, ABA, AerialRaider, Al-Qa-qa, Arabadzhiev, AvantGard, CaeraDenoir, ChrisTina, DanielArmstrong, DarkTower, DeFiHackLabs, Deft_TT, Delvir0, Draiakoo, Eigenvectors, Fulum, Greed, HChang26, Haipls, Hama, Inference, Jiamin, JohnnyTime, Jorgect, Juntao, Kaysoft, Kose, Kow, Krace, MaNcHaSsS, Madalad, MrPotatoMagic, Neon2835, NoamYakov, Norah, Oxsadeeq, PENGUN, REKCAH, Ruhum, Shubham, Silvermist, Soul22, SovaSlava, SpicyMeatball, Talfao, TermoHash, The_Kakers, Toshii, TuringConsulting, Udsen, VAD37, Vagner, Zac, Zach_166, ZdravkoHr, _eperezok, ak1, aldarion, alexfilippov314, alexxander, amaechieth, aslanbek, ast3ros, audityourcontracts, ayden, bdmcbri, bird-flu, blutorque, bronze_pickaxe, btk, c0pp3rscr3w3r, c3phas, cartlex_, cccz, ciphermarco, circlelooper, crunch, cryptothemex, cu5t0mpeo, darksnow, degensec, dethera, devival, dimulski, droptpackets, epistkr, evmboi32, fibonacci, gumgumzum, immeas, innertia, inzinko, jasonxiale, joesan, ke1caM, kimchi, lanrebayode77, lsaudit, mahyar, max10afternoon, merlin, mrudenko, nuthan2x, oakcobalt, openwide, orion, phoenixV110, pontifex, r0ck3tz, rotcivegaf, rvierdiiev, seeques, shenwilly, sl1, slvDev, t0x1c, tallo, tnquanghuy0512, tpiliposian, trachev, twcctop, vangrim, volodya, xAriextz, xeros, xuwinnie, y4y, yobiz, zhaojie

Awards

0 USDC - $0.00

Labels

External Links

Lines of code

https://github.com/code-423n4/2023-10-nextgen/blob/8b518196629faa37eae39736837b24926fd3c07c/smart-contracts/AuctionDemo.sol#L104-L120 https://github.com/code-423n4/2023-10-nextgen/blob/8b518196629faa37eae39736837b24926fd3c07c/smart-contracts/AuctionDemo.sol#L104-L105 https://github.com/code-423n4/2023-10-nextgen/blob/8b518196629faa37eae39736837b24926fd3c07c/smart-contracts/AuctionDemo.sol#L124-L125

Vulnerability details

Impact

Because of combination of multiples issues in the AuctionDemo contract, a malicious user can make a sandwich attack on another user to take the auctionned token/NFT and recover his funds.

Proof of Concept

In the AuctionDemo contract, we have multiples problems.

Firstly, I think for a more safe auction process, when an auction is ended, we mustn't be able to re-bid.

And we can see the functions participateToAuction(), cancelBid() and cancelAllBids() makes a require check for time that block.timestamp <= auctionEndTime:

function participateToAuction(uint256 _tokenid) public payable { require(msg.value > returnHighestBid(_tokenid) && block.timestamp <= minter.getAuctionEndTime(_tokenid) && minter.getAuctionStatus(_tokenid) == true); ... }

And function claimAuction() make a require check for time that block.timestamp >= auctionEndTime.

function claimAuction(uint256 _tokenid) public WinnerOrAdminRequired(_tokenid,this.claimAuction.selector){ require(block.timestamp >= minter.getAuctionEndTime(_tokenid) && auctionClaim[_tokenid] == false && minter.getAuctionStatus(_tokenid) == true); }

As the result when block.timestamp == auctionEndTime, users can potentially claim, participate to the auction and cancel a bid.

There's also the following problem. The status of an auctionInfoData (auctionInfoData[_tokenid][index].status) is set to true inside participateToAuction() and set to false in cancelBid() and cancelAllBids(). This permit to verify if for an index of the array, the bid is claimable or not. The problem inside the claimAuction() is the status is not set to false when ETH are send to the user, this problem turn to a vulnerability in the scenario below.

Because of the time checking problem in the contract functions, check this potential scenario of a sandwich attack:

- Alice and Bob decide to participate in the auction of a tokenID, in using

participateToAuction() - Sarah try to be the highest bidder by sending her transaction in the last accepted

block.timestamp - Bob see that in the mempool and decide to frontrun alice by calling

claimAuction(). Bob claim the tokens because it's the highest bidder and all the bids are send back to all bidders. - The Alice transaction is executed and she becomes the highest bidder and send ETH to the contract.

- Now Bob backrun the Alice transaction in using

cancelBid()for his bid. Because the contract doesn't set theauctionInfoData[_tokenid][index].statusto false inclaimAuction()and now the contract have the Sarah funds (which is of course more than the Bob amount because Sarah send a transaction to be the highest bidder), Bob retrieve his funds by stealing Alice's deposit.

Bob won the Token/NFT for free and he steal the funds of a user.

Now Alice can't withdraw her deposited ETH because the AuctionDemo balance is less than her bid and all call to claimAuction() or cancelBid() wil revert.

And if the same contract is used to auction other tokenId, Alice can withdraw her ETH but impossibility to use claimAuction() for other tokenId because there are an offset between the internal balance of the contract and values saved in all the auctionInfoData[_tokenid][i].bid.

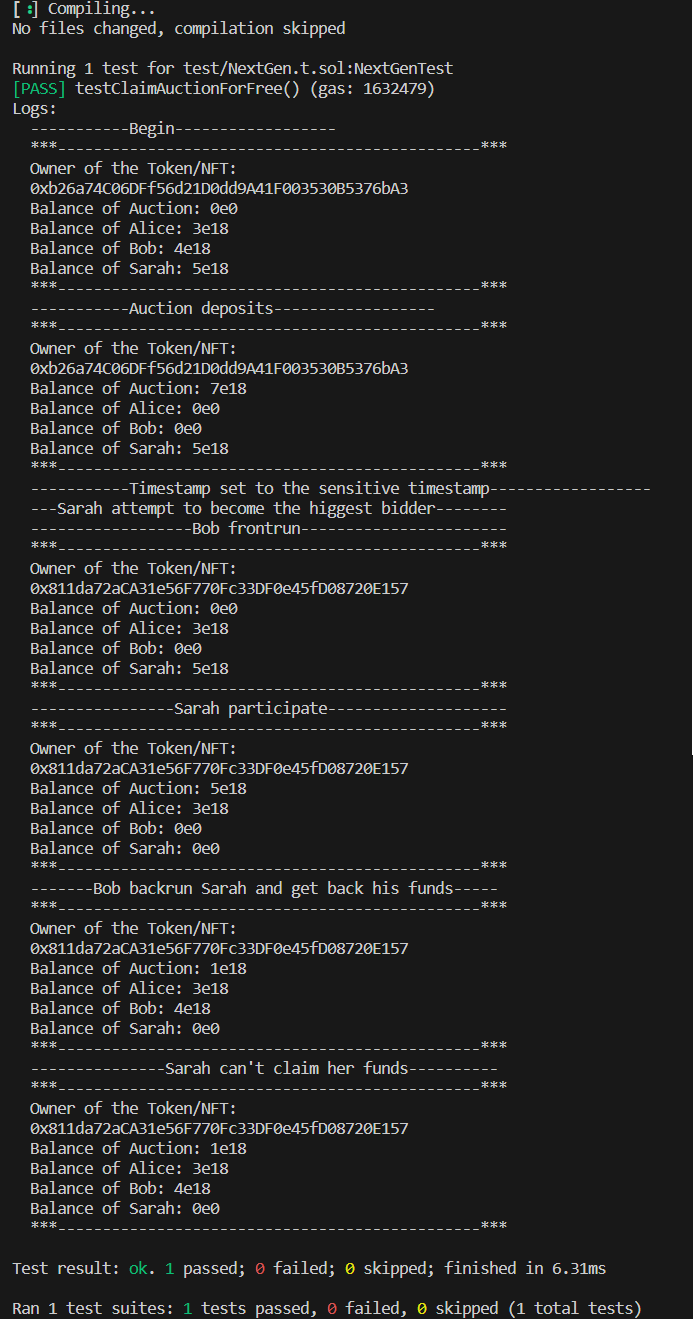

Logs

You have the image with the logs of the PoC

You can check this Gist to setup foundry with the smart contracts for an executable PoC: https://gist.github.com/AxelAramburu/c10597b5ff60616b8a15d091f88de8da

And execute this command: forge test --mt testClaimAuctionForFree -vvv

Tools Used

Manuall Review, Foundry

Recommended Mitigation Steps

You can fix this issue by change the time check in the claimAuction() function, you have also to set the auctionInfoData[_tokenid][i].status to false when the ETH are redeemed:

function claimAuction(uint256 _tokenid) public WinnerOrAdminRequired(_tokenid,this.claimAuction.selector){ -- require(block.timestamp >= minter.getAuctionEndTime(_tokenid) && auctionClaim[_tokenid] == false && minter.getAuctionStatus(_tokenid) == true); ++ require(block.timestamp > minter.getAuctionEndTime(_tokenid) && auctionClaim[_tokenid] == false && minter.getAuctionStatus(_tokenid) == true); auctionClaim[_tokenid] = true; uint256 highestBid = returnHighestBid(_tokenid); address ownerOfToken = IERC721(gencore).ownerOf(_tokenid); address highestBidder = returnHighestBidder(_tokenid); for (uint256 i=0; i< auctionInfoData[_tokenid].length; i ++) { if (auctionInfoData[_tokenid][i].bidder == highestBidder && auctionInfoData[_tokenid][i].bid == highestBid && auctionInfoData[_tokenid][i].status == true) { ++ auctionInfoData[_tokenid][i].status == false IERC721(gencore).safeTransferFrom(ownerOfToken, highestBidder, _tokenid); (bool success, ) = payable(owner()).call{value: highestBid}(""); emit ClaimAuction(owner(), _tokenid, success, highestBid); } else if (auctionInfoData[_tokenid][i].status == true) { ++ auctionInfoData[_tokenid][i].status == false (bool success, ) = payable(auctionInfoData[_tokenid][i].bidder).call{value: auctionInfoData[_tokenid][i].bid}(""); emit Refund(auctionInfoData[_tokenid][i].bidder, _tokenid, success, highestBid); } else {} } }

Assessed type

Timing

#0 - c4-pre-sort

2023-11-15T07:17:47Z

141345 marked the issue as duplicate of #1172

#1 - c4-judge

2023-12-06T21:28:16Z

alex-ppg marked the issue as duplicate of #1323

#2 - c4-judge

2023-12-08T17:58:12Z

alex-ppg marked the issue as satisfactory

Findings Information

Awards

92.5964 USDC - $92.60

Labels

External Links

Lines of code

Vulnerability details

Impact

A user mint a token at an incorrect price and losing funds if he mint on the last authorized block.timestamp during a Linear or Exponential Descending Sale Model.

Proof of Concept

On a Linear or Exponential Descending Sale Model, the admin set the collectionMintCost and the collectionEndMintCost. In context of these sale models, the collectionMintCost is the price for minting a token at the beginning and the collectionEndMintCost the price at the end of the sale.

The minting methods use the function MinterContract::getPrice() to compute the correct price at the actual timing, check the function with the branch for a Linear or Exponential Descending Sale Model:

function getPrice(uint256 _collectionId) public view returns (uint256) { uint tDiff; //@audit If Periodic Sale if (collectionPhases[_collectionId].salesOption == 3) { ... } else if (collectionPhases[_collectionId].salesOption == 2 && block.timestamp > collectionPhases[_collectionId].allowlistStartTime && block.timestamp < collectionPhases[_collectionId].publicEndTime){ tDiff = (block.timestamp - collectionPhases[_collectionId].allowlistStartTime) / collectionPhases[_collectionId].timePeriod; uint256 price; uint256 decreaserate; //@audit If Exponential Descending Sale if (collectionPhases[_collectionId].rate == 0) { price = collectionPhases[_collectionId].collectionMintCost / (tDiff + 1); decreaserate = ((price - (collectionPhases[_collectionId].collectionMintCost / (tDiff + 2))) / collectionPhases[_collectionId].timePeriod) * ((block.timestamp - (tDiff * collectionPhases[_collectionId].timePeriod) - collectionPhases[_collectionId].allowlistStartTime)); //@audit If Linear Descending Sale } else { if (((collectionPhases[_collectionId].collectionMintCost - collectionPhases[_collectionId].collectionEndMintCost) / (collectionPhases[_collectionId].rate)) > tDiff) { price = collectionPhases[_collectionId].collectionMintCost - (tDiff * collectionPhases[_collectionId].rate); } else { price = collectionPhases[_collectionId].collectionEndMintCost; } } if (price - decreaserate > collectionPhases[_collectionId].collectionEndMintCost) { return price - decreaserate; } else { return collectionPhases[_collectionId].collectionEndMintCost; } } else { // fixed price return collectionPhases[_collectionId].collectionMintCost; } }

We can see that if the collectionPhases[_collectionId].salesOption == 2 (it's the number for a descending sale model), and if the block.timestamp is > allowlistStartTime and < publicEndTime. The price is correctly computed.

A little check on the mint() function:

function mint(uint256 _collectionID, uint256 _numberOfTokens, uint256 _maxAllowance, string memory _tokenData, address _mintTo, bytes32[] calldata merkleProof, address _delegator, uint256 _saltfun_o) public payable { ... } else if (block.timestamp >= collectionPhases[col].publicStartTime && block.timestamp <= collectionPhases[col].publicEndTime) { ... } else { // fixed price return collectionPhases[_collectionId].collectionMintCost; } }

But if the publicEndTime is strictly equal to publicEndTime, the returned price is the collectionMintCost instead of collectionEndMintCost because the logic go to the "else" branch. It's an incorrect price because it's the price at the beginning of the collection. And as you can see on mint(), a user can mint a token on the block.timestamp publicEndTime.

User that mint on the last block.timstamp mint at an unexpected price and for all the minting methods which use the getPrice() function.

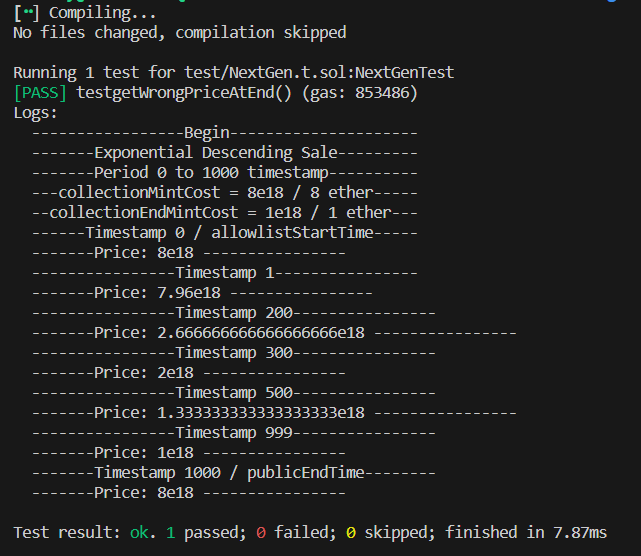

Logs

You can see the logs of the test with this image:

And a link of a gist if you want to execute the PoC directly. https://gist.github.com/AxelAramburu/c10597b5ff60616b8a15d091f88de8da And you can execute the test with this command:

forge test --mt testgetWrongPriceAtEnd -vvv (or with -vvvvv to see all the transaction logs)

Tools Used

Manual Review

Recommended Mitigation Steps

Change the < & > to <= & => on the else if branch inside the getPrice() function.

function getPrice(uint256 _collectionId) public view returns (uint256) { uint tDiff; //@audit-info If Periodic Sale if (collectionPhases[_collectionId].salesOption == 3) { ... -- } else if (collectionPhases[_collectionId].salesOption == 2 && block.timestamp > collectionPhases[_collectionId].allowlistStartTime && -- block.timestamp < collectionPhases[_collectionId].publicEndTime){ ++ } else if (collectionPhases[_collectionId].salesOption == 2 && block.timestamp => collectionPhases[_collectionId].allowlistStartTime && ++ block.timestamp <= collectionPhases[_collectionId].publicEndTime){ tDiff = (block.timestamp - collectionPhases[_collectionId].allowlistStartTime) / collectionPhases[_collectionId].timePeriod; uint256 price; uint256 decreaserate; //@audit If Exponential Descending Sale if (collectionPhases[_collectionId].rate == 0) { price = collectionPhases[_collectionId].collectionMintCost / (tDiff + 1); decreaserate = ((price - (collectionPhases[_collectionId].collectionMintCost / (tDiff + 2))) / collectionPhases[_collectionId].timePeriod) * ((block.timestamp - (tDiff * collectionPhases[_collectionId].timePeriod) - collectionPhases[_collectionId].allowlistStartTime)); //@audit If Linear Descending Sale } else { if (((collectionPhases[_collectionId].collectionMintCost - collectionPhases[_collectionId].collectionEndMintCost) / (collectionPhases[_collectionId].rate)) > tDiff) { price = collectionPhases[_collectionId].collectionMintCost - (tDiff * collectionPhases[_collectionId].rate); } else { price = collectionPhases[_collectionId].collectionEndMintCost; } } if (price - decreaserate > collectionPhases[_collectionId].collectionEndMintCost) { return price - decreaserate; } else { return collectionPhases[_collectionId].collectionEndMintCost; } } else { // fixed price return collectionPhases[_collectionId].collectionMintCost; } }

Assessed type

Invalid Validation

#0 - c4-pre-sort

2023-11-19T12:35:40Z

141345 marked the issue as duplicate of #1391

#1 - c4-judge

2023-12-05T21:23:45Z

alex-ppg marked the issue as selected for report

#2 - alex-ppg

2023-12-05T21:29:31Z

The Warden specifies an inconsistency within the code whereby the price calculation function will misbehave when measured for a sale type of 2 combined with the block.timestamp being the publicEndTime of the collection's sale period.

The finding is correct given that the relevant mint functions in the MinterContract perform an inclusive evaluation for both the allowlistStartTime and the publicEndTime, permitting this vulnerability to manifest when the block.timestamp is exactly equal to the publicEndTime.

The Sponsor has confirmed this in #1391 and I accept the medium severity classification based on the submission's likelihood being low (due to the strict block.timestamp requirement) but the impact being high as an NFT would either be bought at a discount an arbitrary number of times, hurting the artist, or at a high markup, hurting the buyer.

The Warden's submission was selected as the best due to the presence of a PoC with logs that properly emphasize how the issue can be exacerbated depending on the configuration of a sale and its recommended mitigation being sufficient in rectifying the vulnerability.

#3 - c4-judge

2023-12-05T21:29:39Z

alex-ppg marked the issue as satisfactory

Findings Information

🌟 Selected for report: The_Kakers

Also found by: 00xSEV, 0x3b, Arabadzhiev, DeFiHackLabs, Fulum, Madalad, MrPotatoMagic, SpicyMeatball, Tadev, ZanyBonzy, ZdravkoHr, alexfilippov314, audityourcontracts, cheatc0d3, devival, dy, evmboi32, immeas, lsaudit, mrudenko, oakcobalt, oualidpro, pipidu83, r0ck3tz, rishabh, rotcivegaf, tpiliposian, xAriextz

Awards

13.3948 USDC - $13.39

Labels

External Links

[01] - In AuctionDemo contract, a malicious user can carry out a block-stuffing attack to ensure that he is the highest bidder.

A malicious user can carry out a block-stuffing attack to ensure that he is the highest bidder. For example a very rare/expensive Token/NFT is auctionned. The highest bid is more than 50ETH and our attacker Bob absolutetly want this token. He check is nearly the end of the auction time, he place a higher bid of 55ETH and become the new highest bidder.

Now he can check the mempool and make a blockstuffing attack by sending dummy transactions with a lot of gas to prevent the potential participateToAuction() transactions to be integrated into the chain before the end of the auction.

I consider it at low because a low likelihood and because gas cost is expensive on the Ethereum blockchain.

More infos here: https://consensys.github.io/smart-contract-best-practices/attacks/denial-of-service/#gas-limit-dos-on-the-network-via-block-stuffing

[02] - In MinterContract::setCollectionPhases(), lack of verifications can lead to potential issues on the minting process

Lacks of verification inside the MinterContract::setCollectionPhases() functions can lead to potentials time issue on the minting process.

Examples if times parameters are misconfigured are impossibility for user to mint, computation problems inside the getPrice() function, etc.

Recommendations

Add verification like _allowlistStartTime < _allowlistEndTime and _publicStartTime < _publicEndTime.

You can verify also the periods are greater than block.timestamp.

[03] - Function MinterContract::airDropTokens() doesn't check for inputs arrays have the sames sizes

The function MinterContract::airDropTokens() is a function that allows an authorized admin to execute multiples minting in a airdrop for multiples users. It requires multiples inputs and some of them are dynamic sized arrays, and because size of some arrays are not checked to be at the same length, it can lead to minting with _tokenData[] or _saltfun_o[] with zero values, or no minting if the _numberOfTokens[] is less than others arrays (and equal 0).

Recommendations

Add verification to check if the _recipients[], _tokenData[], _saltfun_o[] and _numberOfTokens[] have the same length.

[04] - Rounding error lead to bad distribution of royalties and losing ETH

MinterContract::payArtist() is the function called by admin to pay the artist and the team percentage in sending the deposited amount for a collection. We look that the function makes the following operations to divided the total royalties to the artist and the team.

function payArtist(uint256 _collectionID, address _team1, address _team2, uint256 _teamperc1, uint256 _teamperc2) public FunctionAdminRequired(this.payArtist.selector) { require(collectionArtistPrimaryAddresses[_collectionID].status == true, "Accept Royalties"); require(collectionTotalAmount[_collectionID] > 0, "Collection Balance must be grater than 0"); require(collectionRoyaltiesPrimarySplits[_collectionID].artistPercentage + _teamperc1 + _teamperc2 == 100, "Change percentages"); uint256 royalties = collectionTotalAmount[_collectionID]; ... artistRoyalties1 = royalties * collectionArtistPrimaryAddresses[colId].add1Percentage / 100; artistRoyalties2 = royalties * collectionArtistPrimaryAddresses[colId].add2Percentage / 100; artistRoyalties3 = royalties * collectionArtistPrimaryAddresses[colId].add3Percentage / 100; teamRoyalties1 = royalties * _teamperc1 / 100; teamRoyalties2 = royalties * _teamperc2 / 100; (bool success1, ) = payable(collectionArtistPrimaryAddresses[colId].primaryAdd1).call{value: artistRoyalties1}(""); (bool success2, ) = payable(collectionArtistPrimaryAddresses[colId].primaryAdd2).call{value: artistRoyalties2}(""); (bool success3, ) = payable(collectionArtistPrimaryAddresses[colId].primaryAdd3).call{value: artistRoyalties3}(""); (bool success4, ) = payable(tm1).call{value: teamRoyalties1}(""); (bool success5, ) = payable(tm2).call{value: teamRoyalties2}(""); ... }

Take this scenario with this percentage separation and this little amount:

Artist: 60% 18% 2% Team: 10% 10% royalties = 100495

artistRoyalties1 = 100495 * 61 / 100 artistRoyalties2 = 100495 * 17 / 100 artistRoyalties3 = 100495 * 2 / 100 teamRoyalties1 = 100495 * 11 / 100 teamRoyalties2 = 100495 * 9 / 100 artistRoyalties1 = 61301 artistRoyalties2 = 17084 artistRoyalties3 = 2009 teamRoyalties1 = 11054 teamRoyalties2 = 9044 Total) 61301 + 17084 + 2009 + 11054 + 9044 = 100492

We can see a difference of 3 wei, it not a big amount and it's for this reason I think this issue is low. But with a lot of call for multiples payment during times and calls for all the collections on the contract. Artist are impacted and lose amount of tokens while the dust ETH are losed in the contract.

Recommendations

Change the methods of computations and/or verify is the royalties amount is equal to all the computed amount and add the difference to one amount to prevent dust ETH in the contract.

[05] - In RandomizerNXT contract, the updateAdminsContract() don't verify if the contract is an admin contract

To follow the logic to check that a contract is an admin contract/minter contract/etc. In the updateAdminsContract(), when an admin change the admin contract, there is no check if the contract is an admin contract. By mistake, admin can change the admin contract to another address and the check with the function is not made.

Recommendations

Add this line on the function :

function updateAdminsContract(address _admin) public FunctionAdminRequired(this.updateAdminsContract.selector) { ++ require(INextGenAdmins(_newadminsContract).isAdminContract() == true, "Contract is not Admin"); adminsContract = INextGenAdmins(_admin); }

[06] - An attempt to mint with a RandomizerRNG contract can always revert

The RandomizerRNG contract not set in the constructor the minimum ETH required to make a call to the ArrngController (see below), you can set it directly in the constructor with the minimum value defined by the ArrngController controller in the minimumNativeToken (see the concerned parts of the Arrng controller below). If an admin forgot to set the ethRequired, all the users call will revert.

https://github.com/arrng/arrng-contracts/blob/117d2eadc55eaabb5bea58396dbc8f421d735fd5/contracts/controller/ArrngController.sol#L427 https://github.com/arrng/arrng-contracts/blob/117d2eadc55eaabb5bea58396dbc8f421d735fd5/contracts/controller/ArrngController.sol#L31-L35

Recommendations

Set the ethRequired in the constructor of the contract to the minimal value to avoid the calls revert when a user try to mint.

At the time of writing minimumNativeToken = 1000000000000000.

#0 - 141345

2023-11-25T08:10:16Z

1277 Fulum l r nc 3 0 0

L 1 d dup of https://github.com/code-423n4/2023-10-nextgen-findings/issues/962 L 2 l L 3 l L 4 d dup of https://github.com/code-423n4/2023-10-nextgen-findings/issues/1138 L 5 d dup of https://github.com/code-423n4/2023-10-nextgen-findings/issues/636 L 6 l

#1 - c4-pre-sort

2023-11-25T08:11:33Z

141345 marked the issue as sufficient quality report

#2 - alex-ppg

2023-12-08T15:18:24Z

QA Judgment

The Warden's QA report has been graded B based on a score of 9 combined with a manual review per the relevant QA guideline document located here.

The Warden's submission's score was assessed based on the following accepted findings:

Non-Critical

- [02]: #588

- [04]: #1956

- [05]: #1873

After re-evaluating the Warden's submission, I deem it to be of B comparative quality.

#3 - c4-judge

2023-12-08T15:20:28Z

alex-ppg marked the issue as grade-b

Findings Information

🌟 Selected for report: MrPotatoMagic

Also found by: 3th, Fulum, JohnnyTime, K42, Kose, SAAJ, Toshii, catellatech, cats, clara, digitizeworx, dimulski, dy, glcanvas, hunter_w3b, ihtishamsudo, niki, peanuts

Awards

27.6948 USDC - $27.69

Labels

External Links

General

I audit the NextGen project during 1 week. Previously not audited and I expected to finds some interesting vulnerabilities.

Approach

Most the focus was on a deep understanding of the sales models and the differents ways of minting a token. Verify the correctness of the functions, computations, transfer. Also focused on the generation of the randomness with the differents methods.

Architecture recommendations

Architecture is classic and simple, it's easy to understand how the protocol work and it's a good thing. I recommend the following architectural improvements:

-

Recommend to add a pause feature in the important contract/functions to prevent from worst scenarios.

-

Reinforce your architecture in creating special numbers for each sales models, choose one and implement the good logic in the setup of the collections and phases of minting. It helps you to not make mistake on collections/minting phases creations, have a more clear vision of the sales models and an esaye way to add new sales models in th future.

-

Implement properly the randomness generation with the ChainLink VRF, the Chainlink documentation recommend for example to minting the token on randomness fulfillment to avoid potential revert of the request or multiples requests for the same token. Chekc this documentation: https://docs.chain.link/vrf/v2/security https://docs.chain.link/vrf/v2/subscription#request-and-receive-data https://docs.chain.link/vrf/v2/subscription#subscription-limits

-

You can improve and simplify the

AuctionDemocontract by deleting the power tocancelBid()for a user. This allows you to register the highest bidder when a new one coming, and to remove the for loops on the contract which present Denial-of-Service risks. Provide way to user to withdraw bids when auction is ended, help the user to withdrawn even if theclaimAuction()function is DoS I recommend to look at this auction contract architecture: https://github.com/stader-labs/ethx/blob/mainnet_V0/contracts/Auction.sol

Qualitative analysis

Documentation is writed in simple and good way. You can add a category for security. Some functions explanations are missing from the documentation. The code is well writed but some mistakes and inadvertent error were made on the contracts lead to calculation errors, logic errors, problems of timing in the differents phases of the minting process and errors in randomness creation. Recommend you to add NatSpec in your contracts.

Centralization risks

The Admin contract (NextGenAdmins) is a good idea to manage all the actors of the ecosystem. The team use a multisig wallet and will be the owner of the admin contract to call the admin functions and add/remove privilege of differents actors.

The problem is the power of the admin is too high and lead to potential rug pull scenarios like stealing funds or not paying artist.

Example, admin have a lot of power for changing parameters of a collection in each time and broke important process. You can thinking about a way to have less power in sensitive time to guarantee the security of the users. It reinforces user confidence in the protocol.

Also need to give artists the power to claim their wages.

Systemic risks

The primary systemic is the contracts unupgradability, in case of a security problem (epecially in the NextGenCore), it will be challenging to change logic. Thinking about potentials worst scenarios and implement functionnality (like upgradability, pause functions) and scenario to react quickly in case of issue.

Another risk is calling external contract which can be untrusted with a low level call, add risk of re-entrancy. Also a safeTransferFrom method to an external ERC721 collection which add risk of re-entrancy and/or no transferring token.

MEV is a systemic risk, especially on the auction system with block stuffing attack and front-running attack (example from preventing a user to give a higher bid).

Time Spent

5 days

Time spent:

50 hours

#0 - c4-pre-sort

2023-11-27T14:36:46Z

141345 marked the issue as insufficient quality report

#1 - c4-judge

2023-12-07T16:48:59Z

alex-ppg marked the issue as grade-b