DittoETH - popeye's results

A decentralized stablecoin protocol with an order book design for supercharged staking yield.

General Information

Platform: Code4rena

Start Date: 15/03/2024

Pot Size: $60,500 USDC

Total HM: 16

Participants: 43

Period: 21 days

Judge: hansfriese

Total Solo HM: 5

Id: 348

League: ETH

Findings Distribution

Researcher Performance

Rank: 16/43

Findings: 1

Award: $307.67

🌟 Selected for report: 1

🚀 Solo Findings: 0

Findings Information

🌟 Selected for report: popeye

Also found by: 0xbrett8571, JcFichtner, LinKenji, Rhaydden, SAQ, Sathish9098, albahaca, clara, emerald7017, fouzantanveer, foxb868, hunter_w3b, kaveyjoe, roguereggiant

Labels

Awards

307.6743 USDC - $307.67

External Links

Overview of DittoETH

DittoETH is a decentralized pegged asset issuance protocol built on the Ethereum blockchain. The protocol aims to create a platform for users to mint and trade pegged assets, known as DittoAssets, which are collateralized by liquid staked ETH (LST) such as rETH and stETH. DittoETH draws inspiration from the original Bitshares implementation of polymorphic digital assets (PMDA) and utilizes an orderbook model for asset exchange.

At its core, DittoETH allows users to deposit LSTs or ETH into vaults, which serve as collateral for minting DittoAssets. The protocol introduces the concept of dETH, an internal representation of the deposited collateral that enables users to earn staking rewards. When a user deposits LSTs or ETH, they receive an equivalent amount of dETH, which is escrowed within the protocol.

The minting of DittoAssets occurs through a unique orderbook mechanism. Users can place bids to purchase DittoAssets using their dETH collateral, while shorters can place asks to mint and sell DittoAssets. When a bid and an ask are matched, the DittoAsset is minted and transferred to the bidder, while the shorter receives the dETH collateral from the bidder. This collateral is added to the shorter's existing collateral, allowing them to earn additional staking rewards.

To ensure the stability and solvency of the system, DittoETH requires shorters to maintain a minimum collateralization ratio, typically set at 170% (initialCR). If a shorter's collateralization ratio falls below the liquidation threshold, their position can be liquidated by liquidators, who are incentivized to maintain the health of the protocol.

The protocol also incorporates various mechanisms to handle edge cases and maintain the peg of DittoAssets. These include a dynamic tithe system that adjusts fees based on market conditions, a redemption mechanism that allows DittoAsset holders to redeem their assets for the underlying collateral, and a Treasury Asset Protection Pool (TAPP) that acts as a stability fund to absorb potential losses.

DittoETH shares similarities with other decentralized finance (DeFi) protocols like MakerDAO and Synthetix in terms of collateralized debt positions and pegged asset issuance. However, it distinguishes itself through its use of LSTs as collateral, the orderbook-based minting mechanism, and the incentive structure for shorters to earn additional rewards.

The protocol's smart contracts are organized into a modular structure using the Diamond standard, allowing for flexibility and upgradability. The core contracts include:

VaultFacet: Handles the management of vaults, deposits, and withdrawals of collateral.BridgeRouterFacet: Facilitates the interaction with external LST bridges for depositing and withdrawing collateral.BidOrdersFacetandShortOrdersFacet: Manage the creation and matching of bid and short orders on the orderbook.PrimaryLiquidationFacet: Handles the liquidation of undercollateralized short positions.RedemptionFacet: Enables the redemption of DittoAssets for the underlying collateral.

The protocol also relies on external price oracles, such as Chainlink and Uniswap V3 TWAPs, to determine asset prices and ensure the accuracy of the system.

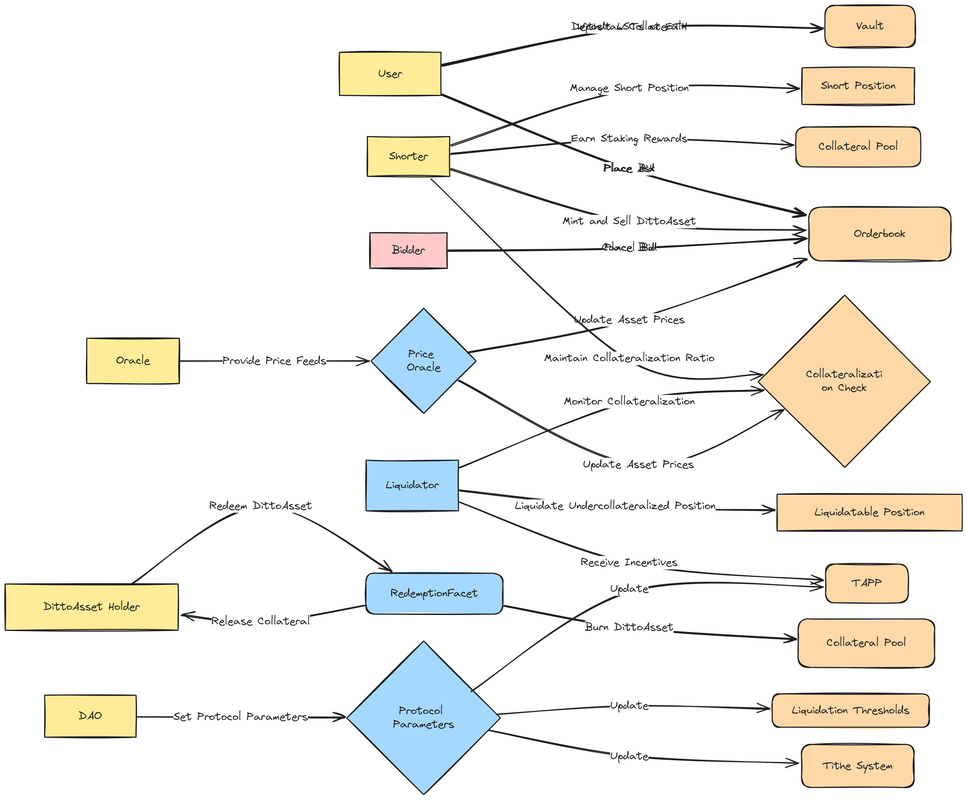

Here's a diagram that provides an overview of the DittoETH protocol:

If the diagram is not visible, please CLICK HERE

Protocol Roles/Actors and Their Privileges

In the DittoETH protocol, there are several key roles and actors, each with their own privileges and responsibilities. These roles include:

1. Users:

- Users are the primary participants in the DittoETH protocol.

- They can deposit LSTs or ETH into vaults to mint dETH, which is escrowed within the protocol.

- Users can place bids on the orderbook to purchase DittoAssets using their dETH collateral.

- Users can also place asks on the orderbook to mint and sell DittoAssets.

- Users have the privilege to withdraw their deposited collateral from vaults, subject to certain conditions and fees.

2. Shorters:

- Shorters are users who mint and sell DittoAssets on the orderbook.

- They provide liquidity to the system by minting DittoAssets and selling them to bidders.

- Shorters must maintain a minimum collateralization ratio (e.g., 170%) to ensure the stability of the minted DittoAssets.

- They earn staking rewards on their collateral, including the additional collateral received from matched bidders.

- Shorters have the privilege to manage their short positions, adjust collateral, and close their positions by repurchasing and burning the minted DittoAssets.

3. Bidders:

- Bidders are users who place bids on the orderbook to purchase DittoAssets using their dETH collateral.

- When a bid is matched with a shorter's ask, the bidder receives the minted DittoAsset.

- Bidders have the privilege to cancel their bids if they are not yet matched.

4. Liquidators:

- Liquidators play a crucial role in maintaining the health and solvency of the DittoETH protocol.

- They monitor the collateralization ratios of shorters' positions.

- If a shorter's position falls below the liquidation threshold, liquidators have the privilege to liquidate the position.

- Liquidators receive incentives from the Treasury Asset Protection Pool (TAPP) for performing liquidations.

5. DittoAsset Holders:

- DittoAsset holders are users who own the minted DittoAssets.

- They have the privilege to redeem their DittoAssets for the underlying collateral through the RedemptionFacet.

- When a DittoAsset is redeemed, it is burned, and the corresponding collateral is released to the holder.

6. DAO (Decentralized Autonomous Organization):

- The DittoETH protocol is governed by a DAO.

- The DAO has the privilege to set and adjust various protocol parameters, such as the tithe system, liquidation thresholds, and TAPP.

- DAO members participate in the governance process and make decisions that impact the protocol's operation and evolution.

7. Oracles:

- Oracles are external entities that provide price feeds for the assets supported by the

DittoETHprotocol. - They play a critical role in ensuring accurate price information for the orderbook and collateralization checks.

- Oracles have the privilege to update asset prices, which are relied upon by the protocol for various calculations and decisions.

Here's a diagram in Mermaid code that illustrates the roles and actors in the DittoETH protocol:

If the diagram is not visible, please CLICK HERE

This diagram shows the relationships and interactions between the different roles and actors in the DittoETH protocol. The arrows indicate the actions and privileges associated with each role, such as depositing collateral, placing orders, maintaining collateralization ratios, liquidating positions, redeeming DittoAssets, governing the protocol, and providing price feeds.

The diagram aims to provide a clear visual representation of the roles and their respective privileges within the DittoETH ecosystem. It highlights the interdependencies and the flow of assets and information among the various actors.

Technical Architecture of DittoETH

DittoETH is built on a robust and modular architecture that adheres to the Diamond standard, enabling the protocol to achieve a high degree of flexibility, upgradability, and separation of concerns. The architecture is meticulously designed to support the core functionalities of minting, trading, and redeeming pegged assets, known as DittoAssets, which are collateralized by liquid staked ETH (LSTs) such as rETH and stETH.

State Management:

At the heart of the DittoETH architecture lies the AppStorage contract, which serves as the central repository for all the critical state variables and data structures of the protocol. The AppStorage contract employs a well-organized system of mappings and structs to efficiently store and manage information pertaining to vaults, assets, users, orders, and short records.

The vault mapping associates a unique identifier (uint256) with a Vault struct, which encapsulates the essential properties and state of each vault within the protocol. This includes data such as the total dETH balance, collateral composition, and yield rates.

The asset mapping establishes a relationship between an asset address and its corresponding Asset struct, which holds asset-specific information like the associated vault, oracle address, and various parameters governing the asset's behavior within the protocol.

User-related data is maintained through the vaultUser and assetUser mappings. The vaultUser mapping links a vault identifier and a user address to a VaultUser struct, storing user-specific data within the context of a particular vault, such as the user's dETH balance and bridge credit. Similarly, the assetUser mapping connects an asset address and a user address to an AssetUser struct, capturing user-specific information pertaining to a specific asset, like the user's escrowed DittoAsset balance.

The bids, asks, and shorts mappings are used to store and manage the orderbook data. Each mapping associates an asset address and an order identifier (uint16) with an Order struct, representing the details of a specific bid, ask, or short order, respectively. This structure allows for efficient retrieval and manipulation of order data.

Lastly, the shortRecords mapping provides a multi-level mapping that links an asset address, a user address, and a short record identifier (uint8) to a ShortRecord struct. This mapping enables the protocol to keep track of the individual short positions of users, including collateral, debt, and yield information.

The centralized state management approach employed by the AppStorage contract offers several advantages. It ensures data consistency across the various components of the protocol, reduces the complexity of inter-contract interactions, and provides a single source of truth for the protocol's state. Moreover, it allows for efficient querying and updating of state variables, optimizing gas costs and improving overall performance.

Sequence Flow Diagram:

If the Sequence flow diagram is not clearly visible, please CLICK HERE

The sequence flow diagram shows the interactions between the various components and actors involved in the protocol's operations.

Vault Management:

The VaultFacet contract is responsible for managing the vaults within the DittoETH protocol. A vault serves as a secure container for the deposited LSTs and ETH collateral, and the VaultFacet provides a range of functions to interact with these vaults.

Users can deposit their LSTs or ETH into a vault through the depositAsset and depositEth functions, respectively. When a user deposits collateral, the VaultFacet contract mints an equivalent amount of dETH, an internal representation of the deposited collateral. The minted dETH is then escrowed within the vault, effectively locking the collateral and allowing the user to participate in the protocol's functionalities.

The VaultFacet contract also enables users to withdraw their collateral from the vault using the withdrawAsset function. Upon withdrawal, the escrowed dETH is burned, and the corresponding collateral is released back to the user. This process ensures that the collateral remains securely stored within the vault until the user initiates a withdrawal.

In addition to deposit and withdrawal operations, the VaultFacet contract plays a crucial role in updating the yield rates associated with the vaults. The updateYield function is responsible for recalculating and updating the yield rates based on the current state of the vault and the underlying collateral. This functionality ensures that users receive accurate and up-to-date yield information on their deposited collateral.

The vault management component of the DittoETH architecture serves as the foundation for the secure storage and accounting of collateral assets. By providing a robust and reliable mechanism for depositing, withdrawing, and tracking collateral, the VaultFacet contract contributes to the overall stability and integrity of the protocol.

Bridge Interaction:

The BridgeRouterFacet contract is a critical component of the DittoETH architecture, facilitating seamless interaction with external LST bridges. This contract acts as an intermediary between the protocol and the supported LST bridges, such as the rETH and stETH bridges, enabling users to deposit and withdraw LSTs through these bridges.

When a user wants to deposit LSTs into the protocol, they can interact with the BridgeRouterFacet contract through the deposit function. This function takes the address of the specific LST bridge and the amount of LSTs to be deposited. Internally, the contract communicates with the corresponding LST bridge contract, initiating the deposit process. The deposited LSTs are then converted into dETH, the internal representation of collateral within the DittoETH protocol.

Similarly, when a user wishes to withdraw their LSTs from the protocol, they can invoke the withdraw function of the BridgeRouterFacet contract. This function takes the address of the LST bridge and the amount of dETH to be withdrawn. The contract interacts with the specified LST bridge to facilitate the withdrawal process, converting the dETH back into the corresponding LSTs and transferring them to the user's wallet.

The BridgeRouterFacet contract also incorporates a credit system to handle scenarios where users deposit and withdraw different types of LSTs. When a user deposits LSTs through a specific bridge, they receive a bridge credit associated with that particular LST. This credit is tracked and managed within the BridgeRouterFacet contract. When a user withdraws LSTs, the contract first checks if they have sufficient bridge credit for the requested LST. If the credit is available, the withdrawal is processed using the credited LSTs. This mechanism ensures that users can only withdraw the LSTs they have previously deposited, preventing potential arbitrage opportunities.

The bridge interaction component of the DittoETH architecture serves a vital purpose by expanding the range of collateral options available to users. By integrating with multiple LST bridges, the protocol offers users the flexibility to deposit and withdraw different types of LSTs, enhancing the overall liquidity and accessibility of the platform. The BridgeRouterFacet contract abstracts away the complexities of interacting with individual LST bridges, providing a unified and user-friendly interface for collateral management.

Moreover, the bridge interaction functionality enables the protocol to adapt and evolve as new LST bridges emerge in the ecosystem. The modular design of the BridgeRouterFacet contract allows for easy integration of additional LST bridges, ensuring that the protocol remains compatible and interoperable with a wide range of collateral assets.

Orderbook:

The orderbook is a fundamental component of the DittoETH architecture, facilitating the matching of buyers and sellers of DittoAssets. The orderbook functionality is implemented through two key contracts: BidOrdersFacet and ShortOrdersFacet.

The BidOrdersFacet contract handles the placement and management of bid orders on the orderbook. Users can place bids by specifying the desired DittoAsset, the price they are willing to pay, and the amount of dETH collateral they wish to use. The contract validates the input parameters, checks the user's available dETH balance, and creates a new bid order on the orderbook. Bid orders are stored in the bids mapping within the AppStorage contract, allowing for efficient retrieval and matching.

On the other hand, the ShortOrdersFacet contract is responsible for managing short orders on the orderbook. Shorters can place asks by specifying the DittoAsset they want to mint and sell, the price they are willing to sell at, and the amount of DittoAssets they wish to create. The contract verifies the shorter's collateral adequacy, ensures compliance with the protocol's collateralization requirements, and creates a new short order on the orderbook. Short orders are stored in the shorts mapping within the AppStorage contract.

The orderbook component of the DittoETH architecture employs a sophisticated matching algorithm to efficiently match bid and short orders. When a new bid or short order is placed, the contracts traverse the orderbook to find the best matching counterparty. The matching algorithm takes into account the price, quantity, and order type to determine the optimal match. If a match is found, the contracts execute the trade, transferring the DittoAssets from the shorter to the bidder and the dETH collateral from the bidder to the shorter.

To optimize gas costs and improve the performance of the orderbook, the DittoETH architecture incorporates a hint system. When placing an order, users can provide hints in the form of order IDs that indicate the expected position of their order in the orderbook. These hints help the contracts quickly locate the appropriate position for the new order, reducing the number of iterations required to find a match. If the provided hints are inaccurate or outdated, the contracts fall back to a more exhaustive search to ensure the correct placement and matching of orders.

The orderbook component also includes mechanisms to handle partial fills and order cancellations. If an order is only partially filled, the remaining quantity is updated, and the order remains active on the orderbook for future matches. Users have the ability to cancel their outstanding orders, which removes them from the orderbook and releases the associated collateral.

The BidOrdersFacet and ShortOrdersFacet contracts work together to create a decentralized and efficient market for minting and trading DittoAssets. The orderbook model promotes price discovery, liquidity, and fair market dynamics. By enabling users to place bids and asks at their desired prices, the architecture fosters a competitive and transparent trading environment.

Moreover, the orderbook component is designed to be flexible and extensible. The modular structure of the contracts allows for the integration of additional order types, such as limit orders or market orders, as well as the incorporation of advanced trading features like order expiration or fill-or-kill orders. This adaptability ensures that the DittoETH protocol can evolve and meet the changing needs of its users over time.

Liquidation:

The PrimaryLiquidationFacet contract plays a crucial role in maintaining the stability and solvency of the DittoETH protocol by facilitating the liquidation of undercollateralized short positions. Liquidation is a critical risk management mechanism that ensures the protocol remains adequately collateralized and protects against potential defaults.

When a shorter opens a short position by minting and selling DittoAssets, they are required to provide sufficient collateral to meet the protocol's collateralization requirements. The collateralization ratio is defined as the ratio of the collateral value to the minted DittoAsset value. If the collateralization ratio of a short position falls below the liquidation threshold, it becomes eligible for liquidation.

The PrimaryLiquidationFacet contract allows liquidators to identify and liquidate undercollateralized short positions. Liquidators continuously monitor the collateralization ratios of short positions and can initiate the liquidation process by calling the liquidate function. This function takes the address of the DittoAsset, the address of the shorter, and the ID of the short position to be liquidated.

Upon receiving a liquidation request, the contract verifies the eligibility of the short position for liquidation. It calculates the current collateralization ratio based on the latest price information from the oracle and compares it against the liquidation threshold. If the short position is indeed undercollateralized, the liquidation process proceeds.

During liquidation, the contract forcefully closes the short position by executing a series of steps. First, it determines the amount of DittoAssets that need to be repurchased to bring the position back to a safe collateralization level. The contract then places a forced bid on the orderbook to buy back the necessary DittoAssets using the shorter's collateral. If the forced bid is successful and the required DittoAssets are acquired, the contract burns the repurchased DittoAssets, effectively reducing the supply and stabilizing the collateralization ratio.

The liquidation process also involves the distribution of liquidation penalties and incentives. The shorter whose position is liquidated incurs a liquidation penalty, which is a percentage of their collateral that is forfeited. This penalty serves as a deterrent against reckless borrowing and encourages responsible collateral management. On the other hand, liquidators who successfully liquidate undercollateralized positions are rewarded with a portion of the liquidation penalty as an incentive for their efforts in maintaining the protocol's stability.

The PrimaryLiquidationFacet contract interacts closely with other components of the DittoETH architecture, such as the orderbook and the price oracle, to execute liquidations accurately and efficiently. It relies on real-time price data from the oracle to calculate collateralization ratios and determine the eligibility of positions for liquidation. The contract also leverages the orderbook to place forced bids and acquire the necessary DittoAssets during the liquidation process.

The liquidation mechanism implemented in the PrimaryLiquidationFacet contract is essential for mitigating the risk of undercollateralized positions and ensuring the overall health and stability of the DittoETH protocol. By promptly liquidating positions that fall below the required collateralization threshold, the contract prevents the accumulation of bad debt and maintains the integrity of the collateral backing the minted DittoAssets.

Moreover, the liquidation functionality acts as a self-regulating mechanism within the protocol. It incentivizes shorters to actively manage their collateral and maintain sufficient collateralization levels to avoid liquidation. At the same time, it encourages liquidators to actively monitor the protocol and participate in the liquidation process, contributing to the decentralized governance and risk management of the platform.

Redemption:

The RedemptionFacet contract is an essential component of the DittoETH architecture, enabling DittoAsset holders to redeem their assets for the underlying collateral. Redemption is a fundamental feature that ensures the convertibility and stability of DittoAssets, allowing users to exit their positions and retrieve the collateral value locked within the protocol.

When a user holds DittoAssets and wishes to redeem them, they can interact with the RedemptionFacet contract through the redeemAssets function. This function takes the address of the DittoAsset and the amount to be redeemed as input parameters. Upon receiving a redemption request, the contract verifies the validity of the request and checks the user's DittoAsset balance to ensure they have sufficient funds to complete the redemption.

Once the redemption request is validated, the RedemptionFacet contract initiates the redemption process. It calculates the corresponding amount of collateral that needs to be released based on the current redemption rate. The redemption rate is determined by the protocol's governance mechanism and takes into account factors such as the overall collateralization ratio, market conditions, and redemption demand.

After determining the collateral amount to be released, the contract burns the redeemed DittoAssets, effectively removing them from circulation. This burning process helps maintain the stability and integrity of the DittoAsset supply, as it ensures that the total supply of DittoAssets remains in sync with the underlying collateral.

Next, the RedemptionFacet contract interacts with the vault management component to release the collateral to the user. It communicates with the VaultFacet contract to withdraw the appropriate amount of collateral from the vault and transfer it to the user's wallet address. The contract ensures that the collateral is securely and accurately released, updating the relevant state variables and balances within the AppStorage contract.

The redemption process implemented in the RedemptionFacet contract is designed to be efficient, transparent, and user-friendly. It provides a seamless way for DittoAsset holders to convert their assets back into the underlying collateral, enabling them to exit their positions and access the value they have stored within the protocol.

The redemption functionality plays a crucial role in maintaining the stability and credibility of the DittoAsset ecosystem. By offering a reliable and accessible redemption mechanism, the DittoETH protocol instills confidence in its users and promotes the widespread adoption of DittoAssets as a stable and trustworthy medium of exchange.

Moreover, the RedemptionFacet contract incorporates various security measures and checks to prevent unauthorized or fraudulent redemption attempts. It validates the authenticity

If the diagram is not visible, please CLICK HERE

Codebase Quality

Code Maintainability and Reliability:

The DittoETH codebase demonstrates a high level of maintainability and reliability. The contracts are well-structured, modular, and adhere to the Diamond standard, which promotes separation of concerns and allows for easy upgradability. The use of libraries, such as LibOrders, LibAsset, and LibShortRecord, encapsulates complex logic and improves code reusability. The contracts are also designed to handle edge cases and potential errors gracefully, with appropriate error handling and revert messages using the Errors library. The use of SafeMath operations ensures that arithmetic operations are protected against overflow and underflow vulnerabilities. Overall, the codebase exhibits a strong emphasis on maintainability and reliability, making it easier for developers to understand, modify, and extend the functionality of the protocol.

Code Comments:

The DittoETH codebase features extensive and informative code comments throughout the contracts. Each contract, function, and important code block is accompanied by clear and concise comments that explain the purpose, functionality, and any relevant considerations. The comments provide valuable insights into the intended behavior of the code, making it easier for developers to understand and navigate the codebase. The use of NatSpec-style comments, such as @notice, @dev, and @param, further enhances the documentation and helps in generating comprehensive documentation for the protocol. The comments also highlight any potential risks, assumptions, or dependencies associated with specific functions or variables. The thoroughness and quality of the code comments demonstrate a commitment to maintainability and facilitating collaboration among developers.

Code Structure and Formatting:

The DittoETH codebase follows a consistent and well-organized code structure and formatting. The contracts are logically grouped and separated into different files based on their functionality, such as VaultFacet, BridgeRouterFacet, BidOrdersFacet, and ShortOrdersFacet. The use of the Diamond standard ensures a clear separation of concerns and promotes modularity. The code is properly indented, and the use of white space enhances readability. The naming conventions for variables, functions, and events are descriptive and follow a consistent pattern, making it easier to understand their purpose and usage. The codebase also makes effective use of Solidity's inheritance and interface mechanisms to promote code reuse and abstraction. Overall, the code structure and formatting of the DittoETH codebase contribute to its maintainability, readability, and ease of understanding.

Strengths:

One of the key strengths of the DittoETH codebase is its modular and extensible architecture. The use of the Diamond standard allows for the separation of concerns and enables the protocol to evolve and adapt over time. New functionality can be added through the creation of additional facets without modifying the existing contracts, promoting upgradability and reducing the risk of introducing bugs or vulnerabilities. The codebase also demonstrates a strong focus on security, with the use of well-established libraries, such as SafeMath, and the implementation of access control mechanisms to prevent unauthorized access to critical functions. The extensive test suite provided with the codebase instills confidence in the correctness and robustness of the protocol. The tests cover various scenarios, edge cases, and potential vulnerabilities, ensuring that the contracts behave as expected and can handle different conditions. The comprehensive documentation, both in the form of code comments and external documentation, is another strength of the DittoETH codebase. The documentation provides a clear and detailed explanation of the protocol's architecture, functionality, and usage, making it easier for developers and users to understand and interact with the system.

Documentation:

The DittoETH protocol benefits from a comprehensive and well-structured documentation. The provided whitepaper offers a high-level overview of the protocol's design, architecture, and key components. It explains the core concepts, such as vaults, collateral management, orderbook matching, liquidation, and redemption, in a clear and accessible manner. The whitepaper also discusses the economic model, incentive structures, and potential use cases of the protocol. In addition to the whitepaper, the codebase itself is thoroughly documented using in-code comments and NatSpec annotations. These comments provide detailed explanations of each contract, function, and important code block, making it easier for developers to understand the purpose and functionality of the code. The documentation also includes usage examples, parameter descriptions, and any relevant considerations or assumptions. The combination of the whitepaper and in-code documentation provides a solid foundation for understanding the DittoETH protocol and facilitates its adoption and integration by developers and users alike.

Here's a diagram illustrating the key components of the DittoETH codebase:

If the diagram is not visible, please CLICK HERE

This diagram highlights the key components of the DittoETH codebase, including the Diamond standard architecture, the various facets responsible for different functionalities, the libraries that encapsulate complex logic, the centralized storage contract (AppStorage), the extensive test suite, and the comprehensive documentation in the form of the whitepaper and in-code comments.

Approach Taken to Audit DittoETH

Pre-Audit Approach:

Before diving into the actual audit of the DittoETH protocol, it was essential to establish a solid foundation and understanding of the project. The first step involved reviewing the provided documentation, including the Litepaper and any available technical specifications. This initial review helped gain a high-level understanding of the protocol's architecture, key components, and intended functionality.

In addition to the project-specific documentation, the audit approach also leveraged prior knowledge and experience in auditing similar DeFi protocols. Familiarity with common vulnerabilities, best practices, and security patterns in the DeFi space provided a valuable starting point for the audit process. This background knowledge allowed for a more targeted and efficient analysis of the DittoETH codebase.

Codebase Approach:

The audit of the DittoETH codebase followed a systematic and thorough approach to ensure comprehensive coverage of all critical components. The codebase was reviewed file by file, focusing on the core functionalities and technical characteristics of each contract. The following table provides an overview of the key contracts audited, along with their importance and management:

| File Name | Core Functionality | Technical Characteristics | Importance and Management |

|---|---|---|---|

| VaultFacet.sol | Manages vaults, deposits, and withdrawals | Vault management, collateral accounting, yield updates | Critical component for secure collateral management and accurate accounting |

| BridgeRouterFacet.sol | Facilitates interaction with external LST bridges | Bridge integration, credit system, deposit/withdrawal | Essential for seamless integration with LST bridges and proper handling of bridge interactions |

| BidOrdersFacet.sol | Handles the placement and matching of bid orders | Orderbook management, bid matching, order settlement | Crucial for accurate order matching, settlement, and maintaining market integrity |

| ShortOrdersFacet.sol | Manages the creation and matching of short orders | Short order placement, collateralization checks | Vital for ensuring proper collateralization and risk management of short positions |

| PrimaryLiquidationFacet.sol | Facilitates the liquidation of undercollateralized positions | Liquidation process, incentives, collateral management | Critical for maintaining protocol solvency and stability through efficient liquidations |

| RedemptionFacet.sol | Enables the redemption of DittoAssets for collateral | Redemption process, collateral release, asset burning | Essential for ensuring the convertibility and stability of DittoAssets |

Publicly Known Issues:

Before conducting the audit, it was important to review any publicly known issues or vulnerabilities associated with the DittoETH protocol on the README. This involved examining the project's GitHub repository, issue tracker, and any relevant public forums or communication channels. By considering publicly known issues, the audit could prioritize the review of potentially affected areas and ensure that known vulnerabilities were adequately addressed. I also explored Solodit for similar protocols to understand what types of bugs are usually occurs on tese types of protocol.

Testing:

Testing played a crucial role in the audit process of DittoETH. The protocol's codebase included an extensive test suite. The test suite covered various scenarios, edge cases, and potential vulnerabilities, providing valuable insights into the behavior and correctness of the smart contracts. I also wrote some tests to analyse and dive deep into the codebase. During the audit, the existing test cases were reviewed and analyzed to assess their comprehensiveness and effectiveness in detecting potential issues. Additional test cases were developed to further explore edge cases, boundary conditions, and specific attack vectors. The tests were executed using the Foundry framework, which provided a robust and efficient testing environment. The test coverage was examined to ensure that all critical functionalities and code paths were adequately tested. The tests proved to be highly valuable in understanding the functionality of each function and the underlying logic of the protocol. They served as a reliable baseline for verifying the expected behavior of the contracts and identifying any deviations or vulnerabilities.

Slither and Bot races:

In addition to manual code review and testing, the audit process also involved the use of static analysis tools like Slither. Slither is a popular open-source static analysis framework for Solidity smart contracts. It helps identify potential vulnerabilities, code quality issues, and best practice violations. The DittoETH codebase was analyzed using various Bots to supplement the manual review process. Slither's analysis and Bots results provided valuable insights into potential security risks. Analysis and Testing Insights:

Robustness of Contracts:

The analysis and testing of the DittoETH codebase revealed a high level of robustness in the design and implementation of the smart contracts. The contracts demonstrated a strong adherence to best practices and security principles. The use of well-established libraries, such as SafeMath, and the proper handling of edge cases and error conditions contributed to the overall robustness of the protocol.

Gas Efficiency:

During the audit, attention was also given to the gas efficiency of the DittoETH contracts. The codebase was analyzed for opportunities to optimize gas consumption without compromising functionality or security. The use of efficient data structures, such as mappings and arrays, and the avoidance of unnecessary computations and storage operations were observed in several instances. However, there were a few areas identified where further gas optimizations could be explored, such as reducing the number of storage reads and writes or using more efficient algorithms for certain computations.

Security Posture:

The security posture of the DittoETH protocol was carefully evaluated during the audit. The codebase demonstrated a strong commitment to security, with the implementation of various security measures and best practices. Access control mechanisms were properly implemented to restrict access to critical functions and state variables. The use of modifiers and role-based access control helped ensure that only authorized entities could perform specific actions. The contracts also included appropriate error handling and input validation to prevent unexpected behavior and mitigate potential attack vectors.

Continuous Improvement:

Throughout the audit process, it was evident that the DittoETH team was committed to continuous improvement and receptive to feedback and recommendations. The team actively engaged in discussions and addressed any findings or concerns raised during the audit. They demonstrated a willingness to iterate on the codebase and incorporate suggested improvements to enhance the protocol's security and functionality. This collaborative approach and openness to feedback contributed to the overall quality and robustness of the DittoETH protocol.

The audit of the DittoETH protocol followed a comprehensive approach that involved a combination of manual code review, testing, static analysis, and consideration of publicly known issues. The codebase was systematically analyzed, focusing on the core functionalities and technical characteristics of each contract. The extensive test suite provided valuable insights into the behavior and correctness of the smart contracts, while tools like Slither complemented the manual review process.

Overview, Concerns, and Recommendations

Vault Management (VaultFacet.sol):

The VaultFacet contract is responsible for managing the vaults within the DittoETH protocol. It provides functions for depositing and withdrawing collateral, minting dETH (an internal representation of the deposited collateral), and updating yield rates. The vault management component ensures the secure storage and accounting of collateral assets.

Concerns:

-

The

depositAssetanddepositEthfunctions allow users to deposit collateral into the vault. However, there is no explicit check to ensure that the deposited amount is greater than zero. While theaddDethfunction inLibBridgeRouterdoes check for a minimum deposit amount, it would be safer to include this check directly in the deposit functions to prevent any potential edge cases. -

The

withdrawAssetfunction enables users to withdraw their collateral from the vault. The function calls theassessDethfunction inLibBridgeRouterto determine the amount of dETH that can be withdrawn based on the user's bridge credit. However, there is no explicit validation to ensure that the returned value fromassessDethdoes not exceed the user's total dETH balance. While this scenario is unlikely given the current implementation, adding an explicit check would provide an extra layer of safety.

Recommendations:

- Consider adding a check in the

depositAssetanddepositEthfunctions to ensure that the deposited amount is greater than zero. This can help prevent any unintended behavior or potential issues arising from zero-value deposits.

function depositAsset(address bridge, uint88 amount) external nonReentrant { if (amount == 0) revert Errors.ZeroAmountDeposit(); // Rest of the function logic }

- To enhance the safety of the

withdrawAssetfunction, consider adding an explicit validation to ensure that the amount returned fromassessDethdoes not exceed the user's total dETH balance. This can be done by comparing the returned value with the user'sethEscrowedbalance in theVaultUserstruct.

function withdrawAsset(address bridge, uint88 dethAmount) external nonReentrant { // Rest of the function logic uint88 withdrawableAmount = LibBridgeRouter.assessDeth(vault, bridgePointer, dethAmount, rethBridge, stethBridge); if (withdrawableAmount > s.vaultUser[vault][msg.sender].ethEscrowed) revert Errors.InsufficientDethBalance(); // Rest of the function logic }

Bridge Interaction (BridgeRouterFacet.sol):

The BridgeRouterFacet contract facilitates the interaction with external LST bridges, such as the rETH and stETH bridges. It allows users to deposit and withdraw LSTs through the bridges, converting them to dETH and vice versa. The bridge interaction component enables seamless integration with different LST protocols and expands the collateral options for users.

Concerns:

-

The

depositanddepositEthfunctions interact with external bridge contracts to deposit LSTs or ETH. While the contract does handle the case when the bridge deposit fails (e.g., by checking the returneddethAmount), there is no explicit validation of the bridge addresses. If an invalid or malicious bridge address is provided, it could lead to unexpected behavior or loss of funds. -

The

withdrawfunction calculates the withdrawal fee percentage based on the market premium/discount between rETH and stETH using a 30-minute TWAP. However, there is no check to ensure that the TWAP values are not stale or manipulated. In case of external oracle failures or price manipulations, the withdrawal fee calculation could be affected, potentially leading to incorrect fees being charged.

Recommendations:

- Implement a whitelist mechanism for valid bridge addresses. Before interacting with a bridge contract, verify that the provided bridge address is included in the whitelist. This can help prevent interactions with invalid or malicious bridge contracts.

mapping(address => bool) private validBridges; function deposit(address bridge, uint88 amount) external nonReentrant { if (!validBridges[bridge]) revert Errors.InvalidBridge(); // Rest of the function logic }

- Consider adding additional checks to ensure the integrity of the TWAP values used in the withdrawal fee calculation. This can include verifying that the TWAP values are not stale (e.g., by checking the timestamp) and implementing a price deviation threshold to detect and handle sudden price fluctuations or manipulations.

function withdrawalFeePct(uint256 bridgePointer, address rethBridge, address stethBridge) internal view returns (uint256 fee) { // Rest of the function logic uint256 rethTwapTimestamp = OracleLibrary.getTwapTimestamp(VAULT.RETH_WETH); uint256 stethTwapTimestamp = OracleLibrary.getTwapTimestamp(VAULT.WSTETH_WETH); if (block.timestamp - rethTwapTimestamp > 30 minutes || block.timestamp - stethTwapTimestamp > 30 minutes) { revert Errors.StaleTwapData(); } uint256 priceDeviationThreshold = 0.1 ether; // 10% deviation threshold if (factorReth > factorSteth * (1 + priceDeviationThreshold) || factorSteth > factorReth * (1 + priceDeviationThreshold)) { revert Errors.PriceDeviationExceeded(); } // Rest of the function logic }

Orderbook (BidOrdersFacet.sol and ShortOrdersFacet.sol):

The orderbook component of the DittoETH protocol is implemented through the BidOrdersFacet and ShortOrdersFacet contracts. These contracts handle the placement and management of bid and short orders on the orderbook. The orderbook facilitates the matching of buyers and sellers of DittoAssets, enabling efficient price discovery and liquidity.

Concerns:

-

The

createBidandcreateLimitShortfunctions allow users to place bid and short orders on the orderbook. While the functions do perform various validations and checks, there is a potential concern regarding the handling of dust amounts. If a bid or short order results in a very small (dust) amount after matching, it could lead to inefficiencies and increased gas costs for subsequent operations on those orders. -

The orderbook matching algorithm implemented in the

bidMatchAlgoandsellMatchAlgofunctions is complex and involves multiple loops and conditions. While the code is well-structured and documented, the complexity of the matching logic increases the potential for unintended behavior or edge cases. Thorough testing and validation of the matching algorithm is crucial to ensure its correctness and robustness.

Recommendations:

- Implement a dust threshold mechanism to handle small order amounts. If the remaining amount of a bid or short order falls below a certain threshold after matching, consider automatically canceling the order and refunding the remaining amount to the user. This can help reduce the number of tiny orders on the orderbook and improve overall efficiency.

uint256 constant DUST_THRESHOLD = 1e15; // Adjust the threshold as needed function bidMatchAlgo(/* ... */) private returns (uint88 ethFilled, uint88 ercAmountLeft) { // Rest of the function logic if (incomingBid.ercAmount < DUST_THRESHOLD) { // Cancel the remaining bid order and refund the user cancelBid(asset, incomingBid.id); return (matchTotal.fillEth, 0); } // Rest of the function logic }

- Conduct thorough testing and validation of the orderbook matching algorithm. Develop a comprehensive test suite that covers various scenarios, edge cases, and potential attack vectors. Perform fuzz testing and property-based testing to identify any unintended behavior or vulnerabilities. Consider engaging external auditors or the community to review and validate the matching logic to ensure its correctness and robustness.

Liquidation (PrimaryLiquidationFacet.sol):

The PrimaryLiquidationFacet contract enables the liquidation of undercollateralized short positions. It allows liquidators to identify and liquidate positions that fall below the required collateralization ratio, helping to maintain the stability and solvency of the DittoETH protocol.

Concerns:

-

The

liquidatefunction performs the liquidation of undercollateralized short positions. During the liquidation process, the contract calculates the liquidation penalty and the caller's fee based on thepenaltyCRandcallerFeePctvalues, respectively. However, there is no explicit check to ensure that these values are within reasonable ranges. If the penalty or caller fee percentages are set too high, it could discourage liquidations and negatively impact the protocol's stability. -

The liquidation process involves the transfer of collateral and fees between the liquidated short position, the liquidator, and the TAPP (Treasury Asset Protection Pool). While the contract does handle various scenarios and edge cases, there is a potential concern regarding the accuracy and correctness of the accounting logic. Any discrepancies or errors in the accounting could lead to incorrect distributions of collateral and fees.

Recommendations:

- Implement safeguards and validations for the

penaltyCRandcallerFeePctvalues used in the liquidation process. Ensure that these values are within reasonable ranges and do not exceed certain thresholds. Consider adding checks in the liquidation function to verify that the penalty and caller fee percentages are valid and do not disincentivize liquidations.

function liquidate(/* ... */) external returns (uint88, uint88) { // Rest of the function logic uint256 maxPenaltyCR = 0.5 ether; // Maximum penalty collateralization ratio uint256 maxCallerFeePct = 0.1 ether; // Maximum caller fee percentage if (m.penaltyCR > maxPenaltyCR) revert Errors.InvalidPenaltyCR(); if (m.callerFeePct > maxCallerFeePct) revert Errors.InvalidCallerFeePct(); // Rest of the function logic }

- Thoroughly review and audit the accounting logic in the liquidation process. Ensure that the calculations for distributing collateral, fees, and penalties are accurate and consistent. Develop comprehensive test cases to verify the correctness of the accounting under different scenarios, including edge cases and potential rounding errors. Consider using formal verification techniques or engaging external auditors to validate the accounting logic and identify any discrepancies or vulnerabilities.

Redemption (RedemptionFacet.sol):

The RedemptionFacet contract enables DittoAsset holders to redeem their assets for the underlying collateral. It provides functionalities for proposing redemptions, disputing redemptions, and claiming the redeemed collateral. The redemption component ensures the convertibility and stability of DittoAssets.

Concerns:

-

The

proposeRedemptionfunction allows users to propose a set of short positions for redemption. The function processes the proposed positions and updates the collateral and debt balances accordingly. However, there is a potential concern regarding the gas cost of this function, especially if a large number of positions are proposed in a single transaction. Processing a large redemption proposal could exceed the block gas limit, making it infeasible to execute. -

The redemption process involves a dispute period during which other users can challenge the proposed redemptions. The dispute logic implemented in the

disputeRedemptionfunction relies on the accuracy and correctness of the provided dispute data. If the dispute data is maliciously crafted or incorrect, it could lead to invalid disputes and potentially disrupt the redemption process.

Recommendations:

- Implement pagination or batching mechanisms for the redemption proposal process. Instead of allowing users to propose a large number of positions in a single transaction, consider limiting the number of positions per proposal and enabling users to submit multiple proposals incrementally. This can help mitigate the gas cost concerns and ensure that redemption proposals can be processed within the block gas limit.

uint256 constant MAX_POSITIONS_PER_PROPOSAL = 100; // Adjust the limit as needed function proposeRedemption(/* ... */) external { // Rest of the function logic if (proposalInput.length > MAX_POSITIONS_PER_PROPOSAL) revert Errors.TooManyPositionsInProposal(); // Rest of the function logic }

- Implement robust validation and error handling mechanisms in the

disputeRedemptionfunction to ensure the integrity of the dispute process. Verify the authenticity and correctness of the provided dispute data before processing a dispute. Consider implementing additional checks and safeguards to prevent malicious or invalid disputes from disrupting the redemption process.

function disputeRedemption(/* ... */) external { // Rest of the function logic if (!isValidDisputeData(disputeData)) revert Errors.InvalidDisputeData(); // Rest of the function logic } function isValidDisputeData(bytes memory disputeData) internal pure returns (bool) { // Implement logic to validate the structure and contents of the dispute data // Return true if the dispute data is valid, false otherwise }

Additionally, consider implementing a reputation system or staking mechanism for disputers to discourage frivolous or malicious disputes. Require disputers to stake a certain amount of tokens, which can be slashed if their disputes are found to be invalid or malicious. This can help maintain the integrity of the redemption process and deter bad actors from disrupting it.

The DittoETH protocol demonstrates a well-designed and thoughtfully implemented architecture for enabling the minting, trading, and redemption of pegged assets. The codebase exhibits a strong commitment to security, modularity, and extensibility. However, as with any complex system, there are certain areas that require careful consideration and additional safeguards to ensure the protocol's robustness and reliability.

The concerns and recommendations highlighted in this overview aim to address potential vulnerabilities, optimize gas efficiency, and enhance the overall security and usability of the DittoETH protocol. Implementing additional validations, safeguards, and error handling mechanisms can help mitigate risks and ensure the smooth operation of the protocol.

It is crucial to conduct thorough fuzz and invariant testing, auditing, and validation of the codebase, especially for critical components such as the orderbook matching algorithm and the liquidation process. Engaging the community, external auditors, and leveraging formal verification techniques can provide additional assurance and help identify any potential issues or vulnerabilities.

Key Components and Analysis of DittoETH

1. Vault Management:

The vault management component, implemented in the VaultFacet contract, plays a crucial role in the DittoETH protocol by ensuring the secure storage and accounting of collateral assets. It provides functions for depositing and withdrawing collateral, minting dETH (an internal representation of the deposited collateral), and updating yield rates.

One of the key strengths of the vault management system is its ability to handle multiple types of collateral, including LSTs (Liquid Staking Tokens) and ETH. The depositAsset and depositEth functions allow users to seamlessly deposit their collateral into the vault, while the withdrawAsset function enables them to withdraw their collateral when needed.

The vault management component maintains accurate accounting of the deposited collateral through the use of the VaultUser struct, which keeps track of each user's dETH balance. The addDeth function in the LibBridgeRouter library ensures that the deposited collateral is properly credited to the user's account and updates the vault's total dETH balance.

To ensure the security and integrity of the collateral, the vault management system incorporates various checks and validations. For example, the withdrawAsset function verifies that the user has sufficient dETH balance before allowing a withdrawal and updates the user's balance accordingly.

Overall, the vault management component provides a robust and flexible foundation for the DittoETH protocol, enabling users to securely deposit and withdraw their collateral while maintaining accurate accounting and yield calculations.

If the diagram is not visible, please CLICK HERE

2. Bridge Interaction:

The bridge interaction component, implemented in the BridgeRouterFacet contract, is responsible for facilitating the integration of external LST bridges into the DittoETH protocol. It allows users to deposit and withdraw LSTs through supported bridges, such as the rETH and stETH bridges, and seamlessly converts them to dETH and vice versa.

The deposit and depositEth functions in the BridgeRouterFacet contract enable users to deposit LSTs or ETH through the specified bridge. The contract interacts with the corresponding bridge contract to initiate the deposit process and converts the deposited assets into dETH, which is then credited to the user's account.

Similarly, the withdraw function allows users to withdraw their LSTs from the protocol by specifying the bridge and the amount of dETH to be withdrawn. The contract communicates with the bridge contract to facilitate the withdrawal process, converting the dETH back into the corresponding LSTs and transferring them to the user's wallet.

One of the notable features of the bridge interaction component is the credit system, which handles scenarios where users deposit and withdraw different types of LSTs. When a user deposits LSTs through a specific bridge, they receive a bridge credit associated with that particular LST. The credit is tracked and managed within the BridgeRouterFacet contract, ensuring that users can only withdraw the LSTs they have previously deposited.

The bridge interaction component also incorporates a withdrawal fee mechanism, which calculates the fee based on the market premium/discount between rETH and stETH using a 30-minute TWAP (Time-Weighted Average Price). This fee serves to prevent arbitrage opportunities and ensure fair pricing for LST withdrawals.

Overall, the bridge interaction component enhances the flexibility and interoperability of the DittoETH protocol by enabling seamless integration with external LST bridges. It provides users with a convenient way to deposit and withdraw different types of LSTs while maintaining accurate accounting and credit tracking.

If the diagram is not visible, please CLICK HERE

3. Orderbook:

The orderbook component, implemented in the BidOrdersFacet and ShortOrdersFacet contracts, is a critical part of the DittoETH protocol as it facilitates the matching of buyers and sellers of DittoAssets. It provides a decentralized and efficient mechanism for price discovery and liquidity provision.

The BidOrdersFacet contract handles the placement and management of bid orders on the orderbook. Users can place bids by specifying the desired DittoAsset, the price they are willing to pay, and the amount of dETH collateral they wish to use. The contract validates the input parameters, checks the user's available dETH balance, and creates a new bid order on the orderbook.

Similarly, the ShortOrdersFacet contract manages the creation and matching of short orders on the orderbook. Shorters can place asks by specifying the DittoAsset they want to mint and sell, the price they are willing to sell at, and the amount of DittoAssets they wish to create. The contract verifies the shorter's collateral adequacy, ensures compliance with the protocol's collateralization requirements, and creates a new short order on the orderbook.

The orderbook component employs a sophisticated matching algorithm to efficiently match bid and short orders. The bidMatchAlgo and sellMatchAlgo functions traverse the orderbook to find the best matching counterparty based on price, quantity, and order type. When a match is found, the contracts execute the trade, transferring the DittoAssets from the shorter to the bidder and the dETH collateral from the bidder to the shorter.

To optimize gas costs and improve performance, the orderbook utilizes a hint system, where users can provide hints in the form of order IDs to indicate the expected position of their order in the orderbook. These hints help the contracts quickly locate the appropriate position for new orders, reducing the number of iterations required for matching.

The orderbook component also handles partial fills and order cancellations. If an order is only partially filled, the remaining quantity is updated, and the order remains active on the orderbook for future matches. Users have the flexibility to cancel their outstanding orders, which removes them from the orderbook and releases the associated collateral.

If the diagram is not visible, please CLICK HERE

4. Liquidation:

The liquidation component, implemented in the PrimaryLiquidationFacet contract, is essential for maintaining the stability and solvency of the DittoETH protocol. It enables the liquidation of undercollateralized short positions, ensuring that the protocol remains adequately collateralized and protects against potential defaults.

When a shorter opens a short position by minting and selling DittoAssets, they are required to provide sufficient collateral to meet the protocol's collateralization requirements. The collateralization ratio, defined as the ratio of the collateral value to the minted DittoAsset value, must be maintained above a certain threshold. If the collateralization ratio falls below the liquidation threshold, the short position becomes eligible for liquidation.

The PrimaryLiquidationFacet contract allows liquidators to identify and liquidate undercollateralized short positions. Liquidators continuously monitor the collateralization ratios of short positions and can initiate the liquidation process by calling the liquidate function, specifying the DittoAsset, the shorter's address, and the ID of the short position to be liquidated.

Upon receiving a liquidation request, the contract verifies the eligibility of the short position for liquidation by calculating the current collateralization ratio based on the latest price information from the oracle. If the short position is indeed undercollateralized, the liquidation process proceeds.

During liquidation, the contract forcefully closes the short position by executing a series of steps. It determines the amount of DittoAssets that need to be repurchased to bring the position back to a safe collateralization level. The contract then places a forced bid on the orderbook to buy back the necessary DittoAssets using the shorter's collateral. If the forced bid is successful and the required DittoAssets are acquired, the contract burns the repurchased DittoAssets, effectively reducing the supply and stabilizing the collateralization ratio.

The liquidation process also involves the distribution of liquidation penalties and incentives. The shorter whose position is liquidated incurs a liquidation penalty, which is a percentage of their collateral that is forfeited. This penalty serves as a deterrent against reckless borrowing and encourages responsible collateral management. On the other hand, liquidators who successfully liquidate undercollateralized positions are rewarded with a portion of the liquidation penalty as an incentive for their efforts in maintaining the protocol's stability.

If the diagram is not visible, please CLICK HERE

5. Redemption:

The redemption component, implemented in the RedemptionFacet contract, enables DittoAsset holders to redeem their assets for the underlying collateral. It provides a mechanism for users to exit their positions and retrieve the value locked within the protocol, ensuring the convertibility and stability of DittoAssets.

The redemption process begins with a user proposing a set of short positions for redemption by calling the proposeRedemption function. The user specifies the DittoAsset, the proposed redemption amount, and the maximum redemption fee they are willing to pay. The contract validates the proposal, checks the user's DittoAsset balance, and verifies that the proposed positions meet the redemption criteria.

Once a redemption proposal is submitted, it enters a dispute period during which other users can challenge the proposed redemptions. The dispute mechanism, implemented in the disputeRedemption function, allows users to provide evidence and dispute the validity of the proposed redemptions. If a dispute is successful, the challenged positions are removed from the redemption proposal, and the remaining positions proceed to the redemption process.

After the dispute period has passed, the redeemer can claim the redeemed collateral by calling the claimRedemption function. The contract verifies that the dispute period has elapsed and processes the approved redemption positions. It calculates the corresponding amount of collateral to be released based on the redemption rate and burns the redeemed DittoAssets, effectively removing them from circulation.

The redemption component also includes a mechanism for shorters to claim any remaining collateral from their redeemed positions. If a shorter's position is fully redeemed and the redeemer fails to claim the collateral, the shorter can call the claimRemainingCollateral function to retrieve their remaining collateral.

To ensure fair pricing and prevent abuse, the redemption process incorporates a dynamic redemption fee mechanism. The fee is calculated based on factors such as the total collateral redeemed, the redemption amount, and the time elapsed since the last redemption. The fee serves to discourage excessive redemptions and maintain the stability of the DittoAsset ecosystem.

If the diagram is not visible, please CLICK HERE

6. Price Oracles:

The DittoETH protocol relies on accurate and reliable price oracles to determine the value of assets and ensure the proper functioning of various components, such as collateralization checks, liquidations, and redemptions. The price oracle component is implemented in the LibOracle library and utilizes both Chainlink price feeds and Uniswap V3 TWAPs (Time-Weighted Average Prices).

The getOraclePrice function in the LibOracle library is responsible for retrieving the price of an asset from the configured oracle. It supports two types of oracles: the base oracle (e.g., ETH/USD) and asset-specific oracles (e.g., BTC/ETH). The function first checks the availability and validity of the price data from the primary oracle (Chainlink). If the primary oracle price is unavailable or outdated, it falls back to using the TWAP price from Uniswap V3.

The oracle component includes circuit breaker mechanisms to handle situations where the oracle price deviates significantly from the protocol's stored price or if the price data is stale. The baseOracleCircuitBreaker function compares the Chainlink price with the protocol's stored price and the TWAP price. If the deviation exceeds a certain threshold (e.g., 50%), it falls back to using the TWAP price to ensure the integrity of the price data.

The twapCircuitBreaker function is used as a fallback mechanism when the primary oracle price is unavailable or invalid. It retrieves the TWAP price from Uniswap V3 based on a specified time interval (e.g., 30 minutes) and verifies the liquidity of the trading pair to ensure the reliability of the price data.

The price oracle component also includes functions for setting and retrieving the stored oracle price and timestamp. The setPriceAndTime function allows the protocol to update the stored price and timestamp, while the getPrice and getTime functions provide access to the stored values.

If the diagram is not visible, please CLICK HERE

7. Access Control and Permissions:

The DittoETH protocol implements a robust access control and permissions system to ensure the security and integrity of the platform. The protocol follows the principle of least privilege, granting specific roles and permissions to different entities based on their responsibilities and requirements.

The access control mechanism is primarily implemented through the use of modifiers and role-based checks within the smart contracts. The Modifiers contract defines a set of modifiers that restrict access to certain functions based on the caller's role or privileges. For example, the onlyDAO modifier ensures that only the designated DAO (Decentralized Autonomous Organization) address can execute specific functions, such as

Code Weakspots and Complexity

1. Vault Management (VaultFacet.sol):

Potential Weakness: The depositAsset and depositEth functions allow users to deposit any amount of collateral, including zero amounts. While the addDeth function in LibBridgeRouter does check for a minimum deposit amount, allowing zero deposits in the VaultFacet could lead to unnecessary transactions and potential confusion for users.

Example Scenario: A user accidentally calls the depositAsset function with an amount of zero. Although the transaction will not have any effect on the user's balance, it will still consume gas and clutter the transaction history.

Complexity: The vault management component interacts with multiple other contracts and libraries, such as LibBridgeRouter and LibVault, which adds complexity to the overall system. Ensuring the correctness and security of these interactions requires careful auditing and testing.

2. Bridge Interaction (BridgeRouterFacet.sol):

Potential Weakness: The deposit and depositEth functions rely on the addDeth function in LibBridgeRouter to update the user's balance and the vault's total dETH. However, there is no explicit validation to ensure that the addDeth function executed successfully. If the addDeth function fails silently, it could lead to inconsistencies in the user's balance and the vault's total dETH.

Example Scenario: If the addDeth function encounters an error or fails to update the user's balance correctly, the user's deposit may not be properly credited, leading to a loss of funds or incorrect accounting.

Complexity: The bridge interaction component involves complex logic for handling different types of collateral (LSTs and ETH) and interacting with external bridge contracts. The withdraw function, in particular, has a significant level of complexity due to the various checks and calculations involved, such as assessing the user's bridge credit and calculating withdrawal fees based on market prices.

3. Orderbook (BidOrdersFacet.sol and ShortOrdersFacet.sol):

Potential Weakness The orderbook matching algorithm implemented in the bidMatchAlgo and sellMatchAlgo functions is complex and involves multiple loops and conditions. This complexity increases the potential for errors or unintended behavior, especially when dealing with edge cases or extreme market conditions.

Example Scenario: If there is a bug in the matching algorithm that causes incorrect order matching or settlement, it could lead to financial losses for users or even exploitation by malicious actors.

Complexity: The orderbook component is one of the most complex parts of the DittoETH protocol. It involves intricate logic for order placement, matching, and settlement, as well as the management of the underlying data structures. The use of a hint system to optimize gas costs and performance adds another layer of complexity to the orderbook implementation.

4. Liquidation (PrimaryLiquidationFacet.sol):

Potential Weakness: The liquidation process relies on the accuracy and reliability of the price oracle to determine the collateralization ratio of short positions. If the price oracle is manipulated or provides incorrect data, it could lead to improper liquidations or allow undercollateralized positions to remain open.

Example Scenario: An attacker manipulates the price oracle to falsely report a lower price for a collateral asset. This manipulation could cause the liquidation threshold to be breached, triggering unnecessary liquidations and causing financial losses for shorters.

Complexity: The liquidation component involves complex calculations and interactions with multiple parts of the protocol, such as the orderbook and the Treasury Asset Protection Pool (TAPP). The liquidate function has to handle various scenarios, such as calculating liquidation penalties, placing forced bids on the orderbook, and distributing incentives to liquidators. This complexity makes the liquidation process prone to errors and requires thorough testing and auditing.

5. Redemption (RedemptionFacet.sol):

Potential Weakness: The redemption process allows users to propose a set of short positions for redemption, which can be disputed by other users during a specified dispute period. However, the dispute mechanism relies on the accuracy and honesty of the disputers. If a malicious user submits false or fabricated evidence to dispute a legitimate redemption proposal, it could delay or prevent the redemption process.

Example Scenario: A malicious user deliberately submits invalid dispute evidence to challenge a valid redemption proposal. This action could cause the redeemer to lose their opportunity to redeem their assets and potentially incur financial losses.

Complexity: The redemption component involves a multi-step process that includes proposal submission, dispute handling, and claim processing. The complexity lies in managing the state transitions, handling disputes, and ensuring the correct distribution of collateral and burning of redeemed DittoAssets. The redemption fee calculation also adds complexity, as it takes into account various factors such as the total collateral redeemed and the time elapsed since the last redemption.

6. Price Oracles (LibOracle.sol):

Potential Weakness: The price oracle component relies on external data sources, such as Chainlink price feeds and Uniswap V3 TWAPs, to provide accurate and up-to-date price information. However, if these external data sources are compromised, manipulated, or experience downtime, it could lead to incorrect price data being used by the protocol, resulting in improper liquidations, redemptions, or other critical operations.

Example Scenario: If the Chainlink price feed for an asset is manipulated to report an artificially low price, it could trigger unnecessary liquidations of short positions, causing financial losses for shorters.

Complexity: The price oracle component has to handle various scenarios and fallback mechanisms to ensure the availability and reliability of price data. The getOraclePrice function has to navigate through different oracle types (base oracle and asset-specific oracles), handle circuit breakers, and fallback to TWAP prices when necessary. This complexity increases the potential for errors and requires careful testing and monitoring.

7. Access Control and Permissions (Modifiers.sol):

Potential Weakness: The access control and permissions system relies on the correct configuration and management of roles and privileges. If the roles are not properly assigned or if there are vulnerabilities in the access control mechanisms, it could lead to unauthorized access to critical functions or sensitive data.

Example Scenario: If the DAO role is accidentally assigned to an untrusted address, it could allow that address to execute privileged functions, such as modifying protocol parameters or withdrawing funds from the TAPP.

Complexity: The access control and permissions system is implemented using modifiers and role-based checks scattered throughout the codebase. While this approach provides flexibility and granularity, it also increases the complexity of the system and makes it harder to reason about the overall security posture. Ensuring the correctness and consistency of access control requires careful auditing and testing.

8. Yield Management (LibVault.sol):

Potential Weakness: The yield management component calculates and distributes the dETH yield based on the vault's total collateral and the elapsed time since the last yield update. However, if the yield calculation formula is incorrect or if there are rounding errors, it could lead to incorrect yield distribution or potential exploits.

Example Scenario: If the yield calculation formula has a vulnerability that allows an attacker to manipulate the yield rate, they could potentially earn more yield than intended, leading to an unfair distribution of rewards.

Complexity: The yield management component involves complex mathematical calculations and interactions with other parts of the protocol, such as the vault and the dETH token. The updateYield function has to handle various edge cases, such as when the vault's collateral is zero or when there is a significant time gap since the last yield update. This complexity increases the potential for errors and requires thorough testing and auditing.

9. Short Record Management (LibShortRecord.sol):

Potential Weakness: The short record management component is responsible for creating, updating, and deleting short records, which represent a user's short position. However, if there are bugs or inconsistencies in the short record management logic, it could lead to incorrect accounting of short positions or potential exploits.

Example Scenario: If the fillShortRecord function has a bug that allows a user to increase their collateral without increasing their debt proportionally, it could lead to an undercollateralized short position and potential loss of funds for the protocol.

Complexity: The short record management component interacts with various other parts of the protocol, such as the orderbook, the liquidation component, and the vault. It has to handle complex calculations and state transitions, such as updating the ercDebtRate and dethYieldRate, and ensuring the consistency of short records across different operations. This complexity increases the potential for errors and requires thorough testing and auditing.

10. Treasury Asset Protection Pool (TAPP):

Potential Weakness: The TAPP is a critical component of the DittoETH protocol that acts as a safety net to absorb potential losses and ensure the stability of the system. However, if the TAPP is not adequately funded or if there are vulnerabilities in the TAPP management logic, it could lead to insufficient protection against black swan events or potential exploits.

Example Scenario: If the TAPP is drained due to a vulnerability or an unexpected market event, it may not have enough funds to cover the losses incurred by the protocol, leading to a loss of confidence and potential collapse of the system.

Complexity: The TAPP involves complex interactions with various components of the protocol, such as the liquidation process, the redemption process, and the yield management system. It requires careful management of funds, accurate accounting, and robust security measures to ensure its effectiveness. The complexity of the TAPP increases the potential for errors and vulnerabilities and requires thorough testing and auditing.