Ondo Finance - Breeje's results

Institutional-Grade Finance, Now Onchain.

General Information

Platform: Code4rena

Start Date: 29/03/2024

Pot Size: $36,500 USDC

Total HM: 5

Participants: 72

Period: 5 days

Judge: 3docSec

Total Solo HM: 1

Id: 357

League: ETH

Findings Distribution

Researcher Performance

Rank: 2/72

Findings: 3

Award: $4,541.99

🌟 Selected for report: 1

🚀 Solo Findings: 0

Labels

Awards

3937.119 USDC - $3,937.12

External Links

Lines of code

Vulnerability details

Proof of Concept

Any User can use mint function in ousgInstantManager contract to mint OUSG tokens by providing USDC token.

It calls internal function _mint where the main logic resides.

function _mint(uint256 usdcAmountIn, address to) internal returns (uint256 ousgAmountOut) { // SNIP: Validation uint256 usdcfees = _getInstantMintFees(usdcAmountIn); uint256 usdcAmountAfterFee = usdcAmountIn - usdcfees; // Calculate the mint amount based on mint fees and usdc quantity uint256 ousgPrice = getOUSGPrice(); ousgAmountOut = _getMintAmount(usdcAmountAfterFee, ousgPrice); require(ousgAmountOut > 0, "OUSGInstantManager::_mint: net mint amount can't be zero"); // SNIP: Transfering USDC ousg.mint(to, ousgAmountOut); }

2 important Points to understand here:

1. OUSG Price Stability:

The contract depends on the OUSG price obtained from an oracle, which is heavily constrained (As per Readme) to ensure stability.

OUSG Price - The OUSG price tracks an off chain portfolio of cash equivalents and treasury bills, price changes are heavily constrained in the OUSG Oracle, which uses the change in the price of SHV to set the allowable OUSG price in between updates. We are aware that the SHV price could differ from the OUSG portfolio, so any findings related to this price discrepancy is out of scope. Also, scenarios where the OUSG price increases by many orders of magnitudes are not realistic and consequently not considered valid.

As per RWAOracleRateCheck Oracle, Constraints includes:

- OUSG price updates restricted to once every

23 hours. - Price deviations limited to a maximum of

1%.

function setPrice(int256 newPrice) external onlyRole(SETTER_ROLE) { if (newPrice <= 0) { revert InvalidPrice(); } @-> if (block.timestamp - priceTimestamp < MIN_PRICE_UPDATE_WINDOW) { revert PriceUpdateWindowViolation(); } @-> if (_getPriceChangeBps(rwaPrice, newPrice) > MAX_CHANGE_DIFF_BPS) { revert DeltaDifferenceConstraintViolation(); } // Set new price int256 oldPrice = rwaPrice; rwaPrice = newPrice; priceTimestamp = block.timestamp; emit RWAPriceSet(oldPrice, newPrice, block.timestamp); }

These constraints ensure relative stability of the OUSG price.

2. Calculation Assumptions:

The calculation of the amount of OUSG tokens to mint assumes a fixed conversion rate of 1 USDC = 1 USD.

Key point:

- The

_getMintAmountfunction calculates the OUSG amount based on the provided USDC amount and the OUSG price obtained from the oracle (By just upscaling and dividing).

function _getMintAmount( uint256 usdcAmountIn, uint256 price ) internal view returns (uint256 ousgAmountOut) { uint256 amountE36 = _scaleUp(usdcAmountIn) * 1e18; ousgAmountOut = amountE36 / price; }

Here, There are No validation checks implemented regarding the current USDC price.

Scenario of Issue

Consider Alice's attempt to mint OUSG tokens by providing 100,000 USDC, assuming no minting fees and OUSG price of 105e18 USD. The calculation yields: 100_000e36 / 105e18 which is approximately 95_000e18 or 95_000 OUSG tokens for the 100_000 USDC provided.

However, in the event of a USDC depeg, where USDC's value deviates from 1 USD:

- The contract's calculation logic remains unchanged.

- Despite the depeg, the OUSG price remains fairly constant (Maximum 1% Deviation Allowed in 23 hours).

This scenario leads to Alice getting close to 95_000 OUSG tokens again for 100_000 USDC provided But this time 100_000 USDC can be worth as low as 87_000 USD if we take recent depeg event in March 2023, where USDC price went as low as 87 cents (Reference).

This way, contract will allow Users to mint excessive OUSG tokens during Depeg event.

Impact

Minting of Excessive Token in case of USDC Depeg.

Tools Used

VS Code

Recommended Mitigation Steps

Ideally, there needs to be an additional oracle to check current Price of USDC and take it's price into the consideration when calculation OUSG tokens to mint.

Assessed type

Context

#0 - c4-pre-sort

2024-04-04T04:22:29Z

0xRobocop marked the issue as duplicate of #297

#1 - c4-judge

2024-04-09T10:03:49Z

3docSec changed the severity to 3 (High Risk)

#2 - c4-judge

2024-04-09T10:04:19Z

3docSec marked the issue as satisfactory

#3 - c4-judge

2024-04-09T10:04:37Z

3docSec marked the issue as selected for report

#4 - 3docSec

2024-04-09T10:05:10Z

Upgraded as High because there is risk of value extraction from the protocol under conditions that can be monitored by an attacker.

#5 - cameronclifton

2024-04-10T19:00:13Z

Ondo has the ability to convert USDC to USD at a 1:1 rate and USD to BUIDL at a 1:1 rate, and this ability can be assumed. Should these abilities be removed this contract will be immediately paused. If someone is able to purchase USDC at a lower price to their benefit that should not negatively affect the protocol.

For the above reasons we do not believe this is a high severity issue.

#6 - c4-sponsor

2024-04-10T20:00:37Z

cameronclifton marked the issue as disagree with severity

#7 - notbozho

2024-04-12T07:32:52Z

Hey @3docSec

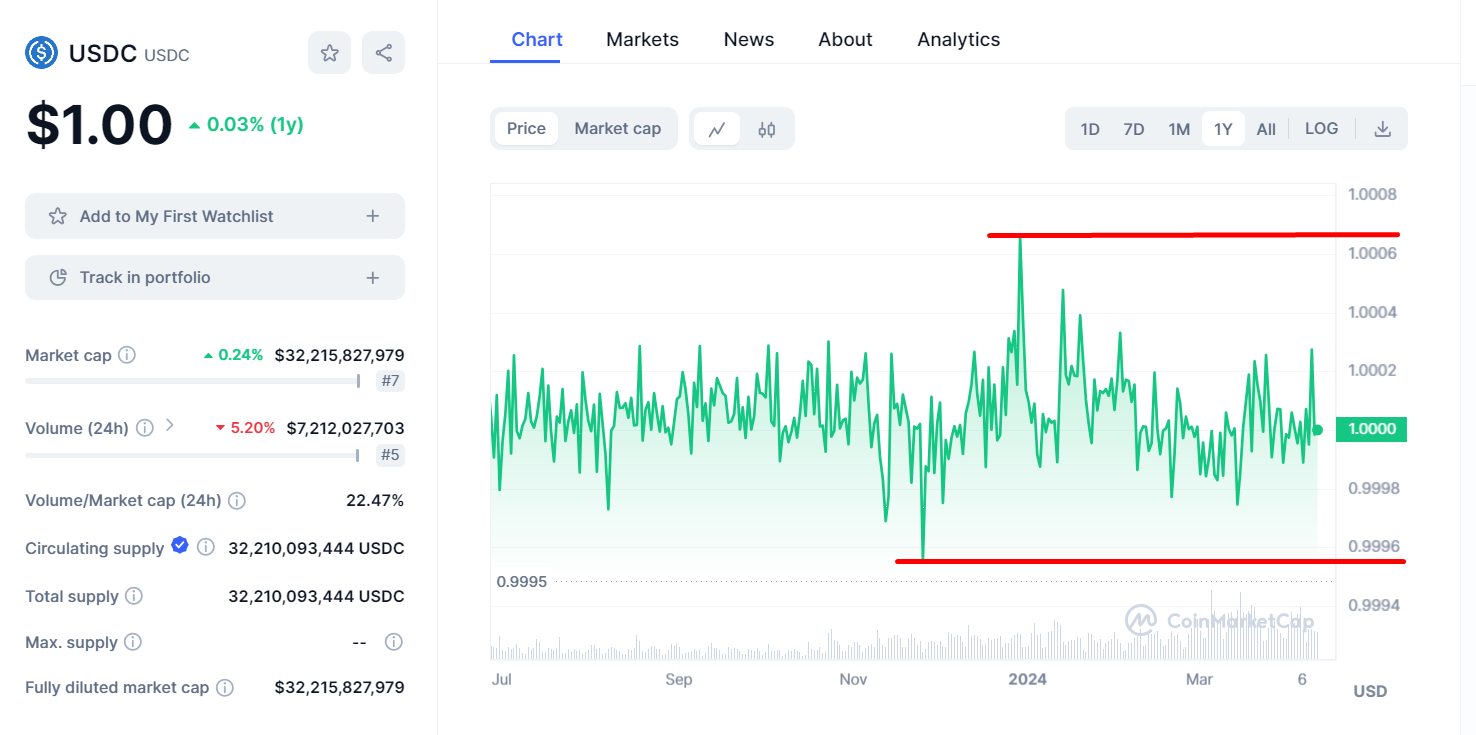

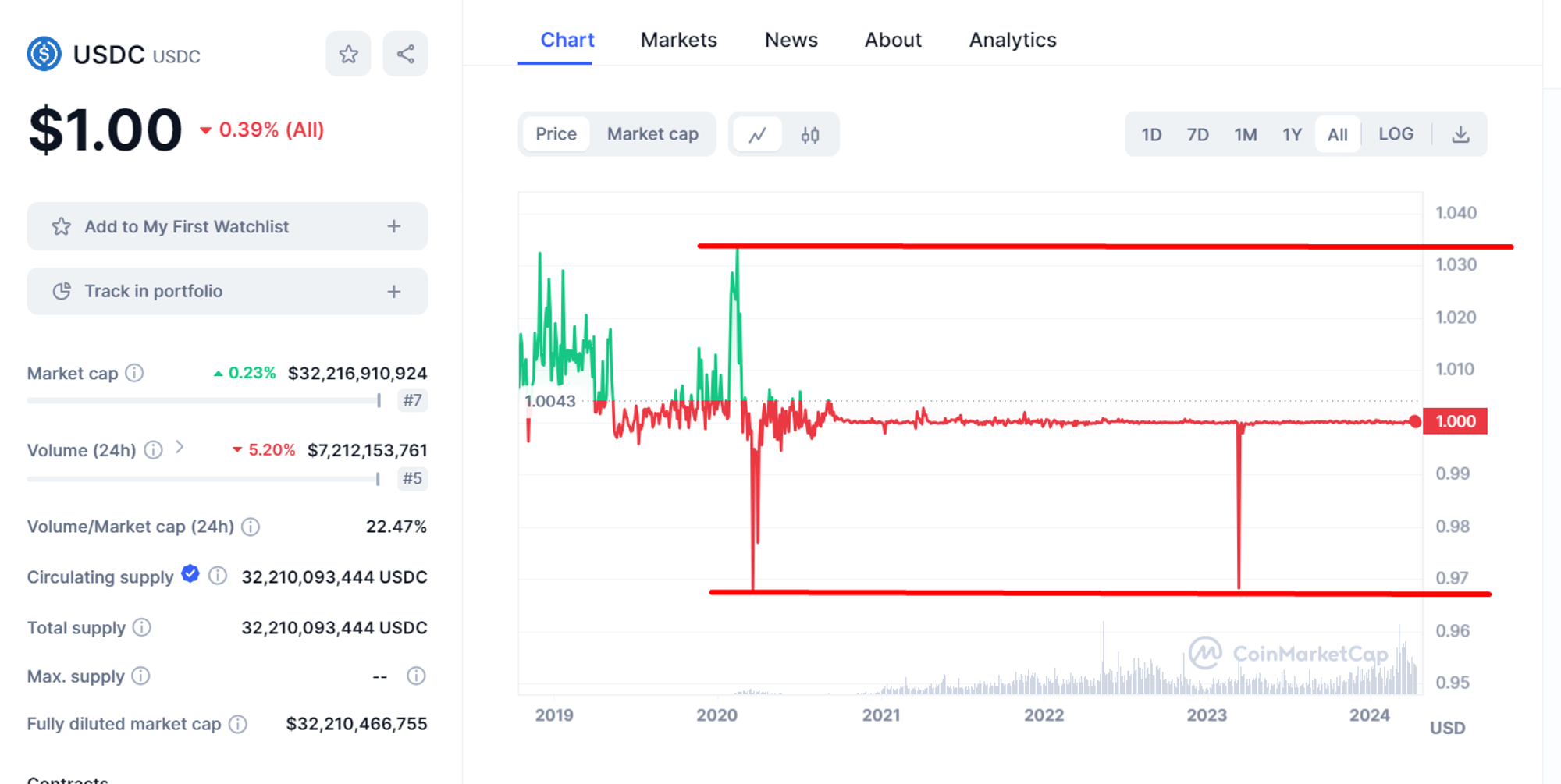

This is a really really rare event. For proof, let's look at the USDC price chart.

Over the past 1 year, the price of USDC has moved the most by $0.001 (the difference between the highest and lowest value) and the price has been consistently maintained at $1 over the past year.

For the all time chart, the USDC low is $0.97 and the high is $1.034 (only $0.064 movement all time!).

Source: coinmarketcap

Also, as the sponsor says above:

Should these abilities be removed this contract will be immediately paused. If someone is able to purchase USDC at a lower price to their benefit that should not negatively affect the protocol.

That being said, this issue should be considered as medium severity.

#8 - 3docSec

2024-04-12T07:53:56Z

Noted, I'll think about it.

#9 - cameronclifton

2024-04-12T23:07:01Z

After further review, we will be mitigating this by adding a Chainlink USDC/USD oracle to the OUSGInsatntManager contract. If the price is lower than what we are comfortable with, all mints and redemptions will be blocked. While we think it is unlikely that we won't be able to convert USDC->USD 1:1 in our backend systems, we decided to do this out of extreme caution.

#10 - c4-sponsor

2024-04-21T16:39:45Z

cameronclifton (sponsor) confirmed

Findings Information

Labels

Awards

490.6256 USDC - $490.63

External Links

Judge has assessed an item in Issue #279 as 2 risk. The relevant finding follows:

[L-04] Risk of Funds Getting Stuck due to Minimum Redemption Amount Update

#0 - c4-judge

2024-04-11T09:15:03Z

3docSec marked the issue as duplicate of #142

#1 - c4-judge

2024-04-11T09:15:07Z

3docSec marked the issue as satisfactory

Findings Information

🌟 Selected for report: immeas

Also found by: 0xAkira, 0xCiphky, 0xGreyWolf, 0xJaeger, 0xMosh, 0xabhay, 0xlemon, 0xmystery, 0xweb3boy, Aamir, Abdessamed, Aymen0909, Breeje, DanielArmstrong, DarkTower, Dots, EaglesSecurity, FastChecker, HChang26, Honour, IceBear, JC, K42, Krace, MaslarovK, Omik, OxTenma, SAQ, Shubham, Stormreckson, Tigerfrake, Tychai0s, VAD37, ZanyBonzy, albahaca, arnie, ast3ros, asui, b0g0, bareli, baz1ka, btk, caglankaan, carrotsmuggler, cheatc0d3, dd0x7e8, grearlake, igbinosuneric, jaydhales, kaden, kartik_giri_47538, m4ttm, ni8mare, niser93, nonn_ac, oualidpro, pfapostol, pkqs90, popeye, radev_sw, samuraii77, slvDev, zabihullahazadzoi

Awards

114.2409 USDC - $114.24

Labels

External Links

QA Report

Low Risk Issues

| Count | Explanation |

|---|---|

| [L-01] | TransparentUpgradeableProxy clashing selector calls may not be delegated |

| [L-02] | Potential DoS in redeem functionality in case USDC enables Fees on transfer |

| [L-03] | Lack of Enforced Timelock on Fee Updates |

| [L-04] | Risk of Funds Getting Stuck due to Minimum Redemption Amount Update |

| [L-05] | Precision loss from minting and redeeming rOUSG can be reduced |

| [L-06] | Some functions can be vulnerable to Slippage |

| Total Low Risk Issues | 6 |

|---|

[L-01] TransparentUpgradeableProxy clashing selector calls may not be delegated

Description

- In the

rOUSGFactorycontract, thedeployRebasingOUSGfunction utilizes theTransparentUpgradeableProxypattern to deploy therOUSGProxycontract.

@-> rOUSGProxy = new TokenProxy(address(rOUSGImplementation), address(rOUSGProxyAdmin), "");

-

However, the

TransparentUpgradeableProxycontract imported from theexternal/openzeppelindirectory is based on an outdated version (4.4.1) of the OpenZeppelin library (Link). -

There is a known Vulnerability in this version of

TransparentUpgradableProxypattern which you can see here.

Impact of this vulnerability as stated officially:

A function in the implementation contract may be inaccessible if its selector clashes with one of the proxy's own selectors. Specifically, if the clashing function has a different signature with incompatible ABI encoding, the proxy could revert while attempting to decode the arguments from calldata.

Recommended Mitigation

Use latest Version of Openzeppelin Library to mitigate this risk.

[L-02] Potential DoS in redeem functionality in case USDC enables Fees on transfer

-

The

_redeemBUIDLfunction in the contractOUSGInstantManagerhelps the redemption of BUIDL tokens. -

Within

_redeemBUIDL, a require statement (marked with @->) verifies the balance of USDC tokens after redemption to ensure a 1:1 ratio with BUIDL tokens redeemed.

function _redeemBUIDL(uint256 buidlAmountToRedeem) internal { require(buidl.balanceOf(address(this)) >= minBUIDLRedeemAmount,"OUSGInstantManager::_redeemBUIDL: Insufficient BUIDL balance"); uint256 usdcBalanceBefore = usdc.balanceOf(address(this)); buidl.approve(address(buidlRedeemer), buidlAmountToRedeem); buidlRedeemer.redeem(buidlAmountToRedeem); @-> require(usdc.balanceOf(address(this)) == usdcBalanceBefore + buidlAmountToRedeem, "OUSGInstantManager::_redeemBUIDL: BUIDL:USDC not 1:1"); }

-

Currently, USDC does not impose fees on token transfers. However, there is a possibility of enabling such fees in the future.

-

If USDC introduces fees on transfers, the require statement validating the balance of USDC tokens post-redemption against the pre-redemption balance will always fail.

-

Consequently, any attempt to redeem BUIDL tokens would result in a reverting transaction, leading to DoS Scenario.

[L-03] Lack of Enforced Timelock on Fee Updates

- The

OUSGInstantManagercontract contains functions such assetMintFeeandsetRedeemFee, which enable the adjustment of fees associated with minting and redeeming operations.

function setMintFee( uint256 _mintFee ) external override onlyRole(CONFIGURER_ROLE) { require(mintFee < 200, "OUSGInstantManager::setMintFee: Fee too high"); emit MintFeeSet(mintFee, _mintFee); mintFee = _mintFee; }

-

These fee adjustment functions do not currently incorporate a timelock mechanism, allowing privileged roles to update fees instantly without prior notice to users.

-

The absence of a timelock mechanism means that fee updates can take effect immediately upon execution of the corresponding function by a privileged role.

-

Users who initiate minting or redemption transactions during or shortly after a fee update may experience discrepancies in the expected fee structure, leading to confusion and potentially financial loss.

[L-04] Risk of Funds Getting Stuck due to Minimum Redemption Amount Update

Consider the following Scenario:

-

The contract currently sets the

setMinimumRedemptionAmountto50_000e6. -

For instance, consider Alice, who has deposited

120,000 USDCto mintXOUSG tokens. -

Alice then initiates a redemption of

60,000 USDCworth of OUSG, assuming she can redeem60,000 USDCmore anytime given the currentsetMinimumRedemptionAmountof50_000e6. -

At some time in future,

CONFIGURE_ROLEdecides to increase this minimum redemption amount to75_000e6which is completely normal behavour on his behalf. -

However, now as the

setMinimumRedemptionAmountis updated to75_000e6, Alice's funds will get stuck as she cannot redeem her amount, falling below the new minimum redemption threshold.

Recommended Mitigation:

Use a Timelock for this call which allows users enough time to make necessary changes to their portfolio.

[L-05] Precision loss from minting and redeeming rOUSG can be reduced

-

In the

OUSGInstantManagercontract, themintRebasingOUSGfunction helps minting ofrOUSGtokens in exchange forUSDC. -

However, the current implementation may result in precision loss due to rounding when transferring

rOUSGtokens to the user (As Acknowledged in Readme as well). -

In

mintRebasingOUSGfunction, ROUSG Amount is calculated fromsharesand then that amount is transferred usingtransferfunction. This can result in loss of dust amount in the contract because of rounding.

function mintRebasingOUSG(uint256 usdcAmountIn) external override nonReentrant whenMintNotPaused returns (uint256 rousgAmountOut) { uint256 ousgAmountOut = _mint(usdcAmountIn, address(this)); ousg.approve(address(rousg), ousgAmountOut); rousg.wrap(ousgAmountOut); rousgAmountOut = rousg.getROUSGByShares(ousgAmountOut * OUSG_TO_ROUSG_SHARES_MULTIPLIER); @-> rousg.transfer(msg.sender, rousgAmountOut); emit InstantMintRebasingOUSG(msg.sender, usdcAmountIn, ousgAmountOut, rousgAmountOut); }

- By using

rousg.transferSharesfunction instead ofrousg.transferfunction, this issue can be easily mitigated.

[L-06] Some functions can be vulnerable to Slippage

-

Given the possibility of rebasing prices based on updates from the Oracle, certain functions within the contract may be vulnerable to slippage or lack of deadline enforcement.

-

Whether it's

transfer,transferSharesor evenapprovefunction, Not having slippage or deadline can lead to issues.

Issue Detail:

- Consider a scenario where User A intends to transfer a specific amount of rOUSG tokens to User B, resulting in a certain number of shares being transferred.

- If the Oracle price updates between transaction initiation and execution, the actual number of shares transferred may differ from the intended amount, leading to unexpected outcomes for the users involved.

- Even if functions such as transferShares are used, users may still unknowingly send more or less rOUSG tokens than intended due to price fluctuations.

For such Scenario, Having a Slippage control and Deadline helps protecting user from unexpected Issues.

#0 - c4-pre-sort

2024-04-05T04:00:42Z

0xRobocop marked the issue as sufficient quality report

#1 - c4-pre-sort

2024-04-05T20:06:52Z

0xRobocop marked the issue as high quality report

#2 - cameronclifton

2024-04-05T23:28:20Z

[L-01] TransparentUpgradeableProxy clashing selector calls may not be delegated This isn't a problem because there are no clashing selector calls right? I think this would be valid only if there was an existing problem. [L-02] Potential DoS in redeem functionality in case USDC enables Fees on transfer It is not realistic to assume this contract will work perfectly should the USDC or BUIDL token change in such a drastic manner [L-03] Lack of Enforced Timelock on Fee Updates This seems like a feature suggestion rather than a vulnerability. I believe the code is working as intended here [L-04] Risk of Funds Getting Stuck due to Minimum Redemption Amount Update See other response related to this issue (it is not fair to assume that this is the only way users can perform redemptions) [L-05] Precision loss from minting and redeeming rOUSG can be reduced Interesting, please provide a concrete example [L-06] Some functions can be vulnerable to Slippage See other response regarding slippage

#3 - c4-sponsor

2024-04-05T23:28:23Z

cameronclifton marked the issue as disagree with severity

#4 - c4-sponsor

2024-04-05T23:29:33Z

cameronclifton (sponsor) acknowledged

#5 - c4-judge

2024-04-10T07:08:53Z

3docSec marked the issue as grade-a

#6 - Breeje16

2024-04-11T08:52:15Z

Hi @3docSec,

L-04 is a dup of #44 and falls under #142 umbrella.

#7 - 3docSec

2024-04-11T09:15:44Z

L-04 is a dup of https://github.com/code-423n4/2024-03-ondo-finance-findings/issues/44 and falls under https://github.com/code-423n4/2024-03-ondo-finance-findings/issues/142 umbrella.

Thanks for flagging ✅