PoolTogether - DarkTower's results

General Information

Platform: Code4rena

Start Date: 04/03/2024

Pot Size: $36,500 USDC

Total HM: 9

Participants: 80

Period: 7 days

Judge: hansfriese

Total Solo HM: 2

Id: 332

League: ETH

Findings Distribution

Researcher Performance

Rank: 16/80

Findings: 2

Award: $340.98

🌟 Selected for report: 1

🚀 Solo Findings: 0

Findings Information

🌟 Selected for report: DarkTower

Also found by: 0xJaeger, 0xJoyBoy03, 0xRiO, 0xkeesmark, 0xlemon, 0xmystery, Abdessamed, AcT3R, Afriauditor, AgileJune, Al-Qa-qa, Aymen0909, Daniel526, DanielTan_MetaTrust, Dots, FastChecker, Fitro, GoSlang, Greed, Krace, McToady, SoosheeTheWise, Tripathi, asui, aua_oo7, btk, crypticdefense, d3e4, dd0x7e8, dvrkzy, gesha17, iberry, kR1s, leegh, marqymarq10, n1punp, pa6kuda, radin100, sammy, smbv-1923, trachev, turvy_fuzz, valentin_s2304, wangxx2026, y4y, yotov721, yvuchev, zhaojie

Awards

1.9047 USDC - $1.90

Labels

External Links

Lines of code

Vulnerability details

Impact

Any fee claim by the fee recipient lesser than the accrued internal accounting of the yieldFeeBalance is lost and locked in the PrizeVault contract with no way to pull out the funds.

Proof of Concept

The claimYieldFeeShares allows the yieldFeeRecipient fee recipient to claim fees in yields from the PrizeVault contract. The claimer can claim up to the yieldFeeBalance internal accounting and no more. The issue with this function is it presents a vulnerable area of loss with the _shares argument in the sense that if the accrued yield fee shares is 1000 shares and the claimer claims only 10, 200 or even any amount less than 1000, they forfeit whatever is left of the yieldFeeBalance e.g if you claimed 200 and hence got minted 200 shares, you lose the remainder 800 because it wipes the yieldFeeBalance 1000 balance whereas only minted 200 shares.

Let's see a code breakdown of the vulnerable claimYieldFeeShares function:

function claimYieldFeeShares(uint256 _shares) external onlyYieldFeeRecipient { if (_shares == 0) revert MintZeroShares(); uint256 _yieldFeeBalance = yieldFeeBalance; if (_shares > _yieldFeeBalance) revert SharesExceedsYieldFeeBalance(_shares, _yieldFeeBalance); yieldFeeBalance -= _yieldFeeBalance; // @audit issue stems and realized next line of code _mint(msg.sender, _shares); // @audit the point where the claimant gets to lose emit ClaimYieldFeeShares(msg.sender, _shares); }

This line of the function caches the total yield fee balance accrued in the contract and hence, the fee recipient is entitled to e.g 100

uint256 _yieldFeeBalance = yieldFeeBalance;

This next line of code enforces a comparison check making sure the claimer cannot grief other depositors in the vault because the claimant could for example try to claim and mint 150 shares whereas they are only entitled to 100.

if (_shares > _yieldFeeBalance) revert SharesExceedsYieldFeeBalance(_shares, _yieldFeeBalance);

This line of code subtracts the cached total yield fee balance from the state yield fee balance e.g 100 - 100. So if say Bob the claimant tried to only mint 50 shares at this point in time with the _shares argument, the code wipes the entire balance of 100

yieldFeeBalance -= _yieldFeeBalance;

And this line of code then mints the specified _shares amount e.g 50 shares to Bob.

_mint(msg.sender, _shares);

So what essentially happens is:

- Total accrued fee is 100

- Bob claims 50 shares of the 100

- Bob gets minted 50 shares

- Bob loses the rest 50 shares

Here's a POC for this issue. Place the testUnclaimedFeesLostPOC function inside the PrizeVault.t.sol file and run the test.

function testUnclaimedFeesLostPOC() public { vault.setYieldFeePercentage(1e8); // 10% vault.setYieldFeeRecipient(bob); // fee recipient bob assertEq(vault.totalDebt(), 0); // no deposits in vault yet // alice makes an initial deposit of 100 WETH underlyingAsset.mint(alice, 100e18); vm.startPrank(alice); underlyingAsset.approve(address(vault), 100e18); vault.deposit(100e18, alice); vm.stopPrank(); console.log("Shares balance of Alice post mint: ", vault.balanceOf(alice)); assertEq(vault.totalAssets(), 100e18); assertEq(vault.totalSupply(), 100e18); assertEq(vault.totalDebt(), 100e18); // mint yield to the vault and liquidate underlyingAsset.mint(address(vault), 100e18); vault.setLiquidationPair(address(this)); uint256 maxLiquidation = vault.liquidatableBalanceOf(address(underlyingAsset)); uint256 amountOut = maxLiquidation / 2; uint256 yieldFee = (100e18 - vault.yieldBuffer()) / (2 * 10); // 10% yield fee + 90% amountOut = 100% vault.transferTokensOut(address(0), bob, address(underlyingAsset), amountOut); console.log("Accrued yield post in the contract to be claimed by Bob: ", vault.yieldFeeBalance()); console.log("Yield fee: ", yieldFee); // yield fee: 4999999999999950000 // alice mint: 100000000000000000000 assertEq(vault.totalAssets(), 100e18 + 100e18 - amountOut); // existing balance + yield - amountOut assertEq(vault.totalSupply(), 100e18); // no change in supply since liquidation was for assets assertEq(vault.totalDebt(), 100e18 + yieldFee); // debt increased since we reserved shares for the yield fee vm.startPrank(bob); vault.claimYieldFeeShares(1e17); console.log("Accrued yield got reset to 0: ", vault.yieldFeeBalance()); console.log("But the shares minted to Bob (yield fee recipient) should be 4.9e18 but he only has 1e17 and the rest is lost: ", vault.balanceOf(bob)); // shares bob: 100000000000000000 assertEq(vault.totalDebt(), vault.totalSupply()); assertEq(vault.yieldFeeBalance(), 0); vm.stopPrank(); }

Test logs and results: Logs: Shares balance of Alice post mint: 100000000000000000000 Accrued yield in the contract to be claimed by Bob: 4999999999999950000 Yield fee: 4999999999999950000 Accrued yield got reset to 0: 0 But the shares minted to Bob (yield fee recipient) should be 4.9e18 but he only has 1e17 and the rest is lost: 100000000000000000

Tools Used

Manual review + foundry

Recommended Mitigation Steps

Adjust the claimYieldFeeShares to only deduct the amount claimed/minted

function claimYieldFeeShares(uint256 _shares) external onlyYieldFeeRecipient { if (_shares == 0) revert MintZeroShares(); - uint256 _yieldFeeBalance = yieldFeeBalance; - if (_shares > _yieldFeeBalance) revert SharesExceedsYieldFeeBalance(_shares, _yieldFeeBalance); + if (_shares > yieldFeeBalance) revert SharesExceedsYieldFeeBalance(_shares, yieldFeeBalance); - yieldFeeBalance -= _yieldFeeBalance; + yieldFeeBalance -= _shares; _mint(msg.sender, _shares); emit ClaimYieldFeeShares(msg.sender, _shares); }

Assessed type

Other

#0 - c4-pre-sort

2024-03-11T21:33:13Z

raymondfam marked the issue as sufficient quality report

#1 - c4-pre-sort

2024-03-11T21:33:23Z

raymondfam marked the issue as duplicate of #10

#2 - c4-pre-sort

2024-03-13T04:36:27Z

raymondfam marked the issue as high quality report

#3 - c4-pre-sort

2024-03-13T04:36:34Z

raymondfam marked the issue as not a duplicate

#4 - c4-pre-sort

2024-03-13T04:36:38Z

raymondfam marked the issue as primary issue

#5 - raymondfam

2024-03-13T04:39:54Z

It was deducting _shares in the previous vault though.

#6 - c4-sponsor

2024-03-13T15:56:20Z

trmid (sponsor) confirmed

#7 - trmid

2024-03-14T22:12:51Z

#8 - c4-judge

2024-03-15T07:34:12Z

hansfriese marked the issue as satisfactory

#9 - c4-judge

2024-03-15T07:34:17Z

hansfriese marked the issue as selected for report

Findings Information

Labels

Awards

339.0819 USDC - $339.08

External Links

1. Preface

This analysis report for PoolTogether has been approached with the following key points and goals in mind:

- Devoid of redundant documentation the protocol is familiar with.

- Engineered towards provision of valuable insights and edge case issues the protocol left unnoticed.

- Simple to grasp call-trace diagrams for first-time users who stumble upon this report in the future.

2. Review process

D1-2:

- Understanding of PoolTogether's concept

- Mapping out security and attack areas relating to shares, assets, dust accumulation, yield & prize claims.

- Keeping track of the outlined areas with notes on contracts in-scope

D2-4:

- Brainstorm possible reachability of undesired states

- Test the areas identified

- Further review of contract-level mitigations

D4-7:

- Apply mitigations

- Draft & submit report

3. Architectural Recommendations

Testing suite:

Rich coverage - The PoolTogether team has tried to ensure the codebase is rigoriously tested. There exists a plethora of unit tests, some stateless fuzz tests, invariant and integration tests within the test suite bringing the coverage up over 80%. The team has tested the contracts in-scope with various functioning environments and integrations. This technique covers testing for expected inputs/outputs as well as fail-safe end results for those unexpected inputs. Such in-depth suite of unit & stateless fuzzing tests ensure a pretty good coverage for the core functions call traces. But as with any testing suite, even 100% doesn't mean all lines of code are covered and tested with every inputs or call-traces that can happen.

What is unique within the PoolTogether v5 vaults?

-

Dust utilization: During deposits of assets into an ERC4626 vault, you'd typically expect to be impacted by rounding in the case your deposit amounts are not completely whole e.g 199 aUSDC, 99 aUSDC etc. PoolTogether has a dust implementation to use such dust amounts for the next deposit. This is facilitated

-

Prize claims generated by earned yield: There's a unique feature added in the PoolTogether v5 ERC4626 vaults. Deposits occur in the

PrizeVaultcontract, such deposits are deposited into a yield bearing strategy calledyieldVaultse.g on Aave. TheseyieldVaultsearn tokens that is then sent back to thePrizeVault. Which are then contributed to theprizePoolsto faciliate prize allocations to winners after a round is drawn. -

Implementation of SafeCast: In the earlier version of the v5 vault, the uint datatypes didn't implement a safe casting during withdraws for example allowing users depositing the max of uint96 - 1 twice, sending uint96 * 2 for the user during withdraws but only burning 1 of 2 such deposits (uint96 max) from the user thereby allowing the user another claim to a supposed share that has already been sent and engineering a steal from other users. In the current implementation, the team kept the

SafeCastuint castings addressed in the previous mitigation of the v5.

Comparison between PoolTogether and Spectra Vaults

| Feature | PoolTogether | Spectra |

|---|---|---|

| Goal | Permissionless yield bearing vaults building upon older version of PoolTogether vaults | A permissionless interest rate derivatives protocol on Ethereum |

| Draws | Deposits are pooled together in the PrizeVault contracts. These deposits are then deposited into a yield vault for example on Aave. The yield earned from such strategies are pooled and some portion is awarded to prize winner. The prize claim is facilitated automatically to the winner | No such feature exists within the Spectra protocol. It is important to understand Spectra and PoolTogether differ quite a lot but they have some similarities. For example, while you don't have any prize claims, you actually still deposit into an ERC4626 vault that can unwrap your yield with interest right away |

| Rounding protection | PoolTogether has implemented a dust strategy facilated by yielf buffers. When the PrizeVault contracts are deployed, the deployer is to fund it with some initial insignificant asset balance e.g 1 USDC to cover as much as 1 million USDC rounding errors hence acting as a buffer for fail-safe rounding that doesn't impact user deposits/withdrawals | Technically, you don't have such protection within the Spectra ERC4626 vaults. Your deposits are not protected by buffers. Instead the Spectra team have tried their best to mitigate this by writing code that does as best as it can to round in favor of the user which means in some cases, rounding issues still worry user withdrawals |

| Share mints | Share mints are 1:1. If you deposit 10 USDC, you get 10 shares | Share mints are relative to your IBT token balance and can become more when you unwrap into a yield and principal token - YT and PT tokens respectively |

Major comparison between current implementation and previous v5 vault

| V5 Old Vaults | V5 New Vaults |

|---|---|

| Dust strategy: This strategy didn't exist within the previous vault's implementation causing rounding issues. | Dust strategy: This enforces a yield buffer can be utilized to account for rounding that favors both the user and protocol. When a vault is deployed, the deployer is advised to send some amount of the underlying token to the vault to cover rounding issues, essentially donating these minimal amounts which can range between 0.1 USDC for example to anywhere up to 1 or 10 USDC. The donation can be carried out by the deployer or any other address. |

4. Call trace diagrams

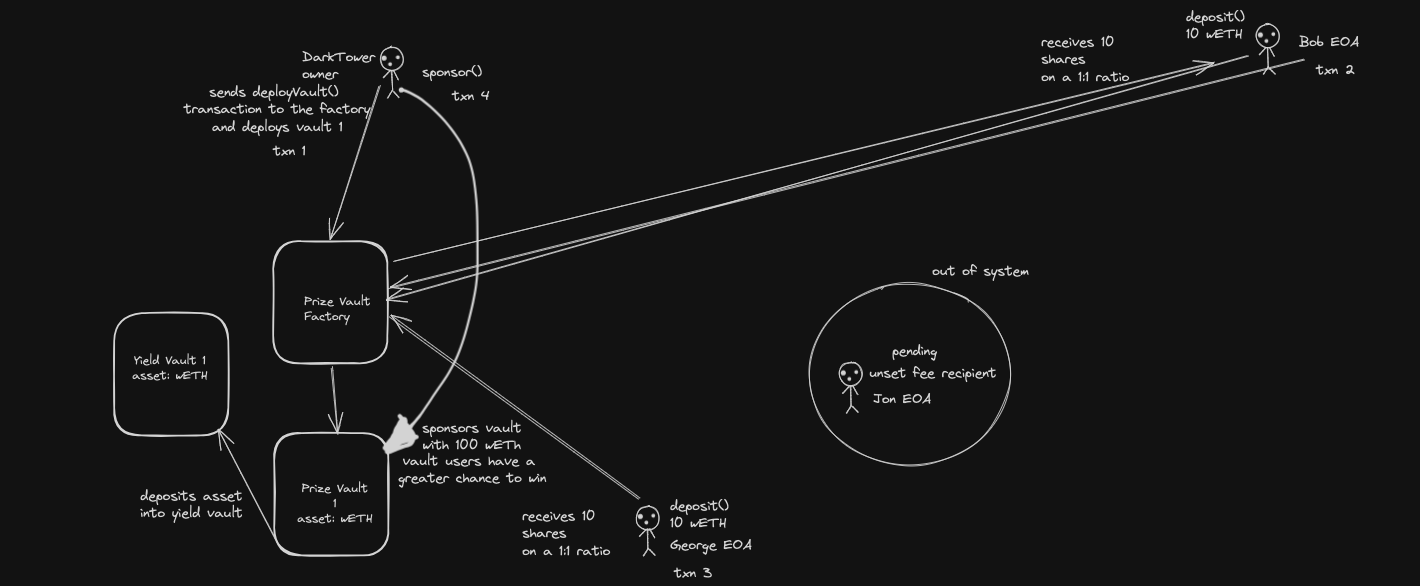

Entry point:

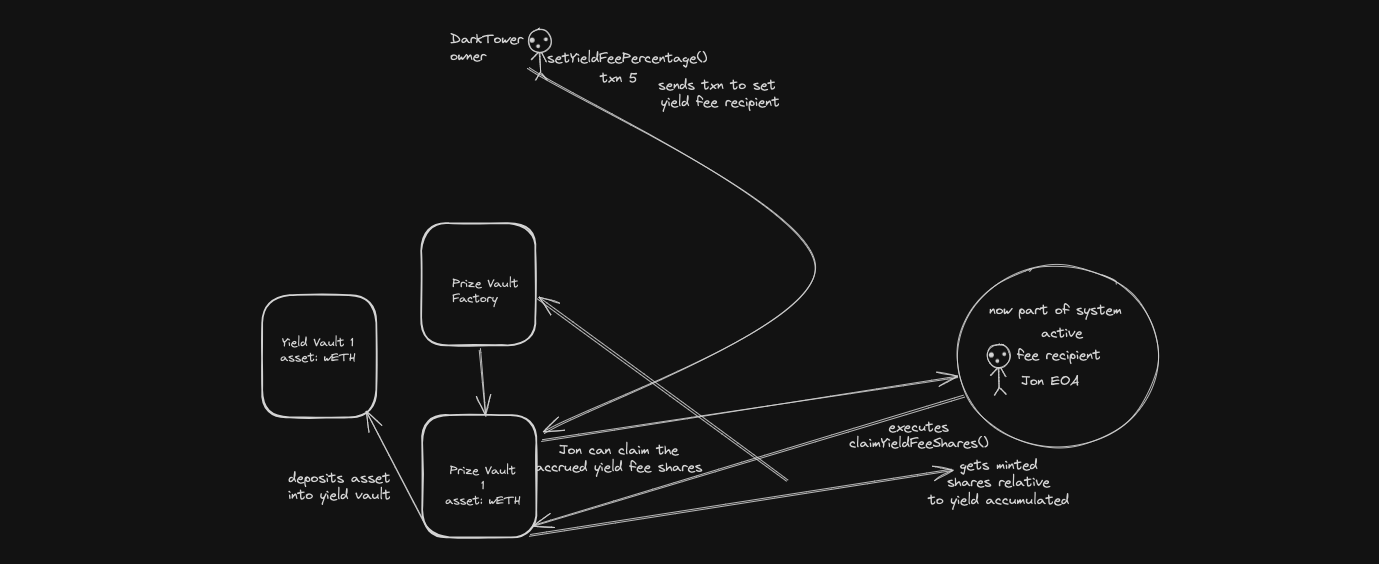

Yield claims:

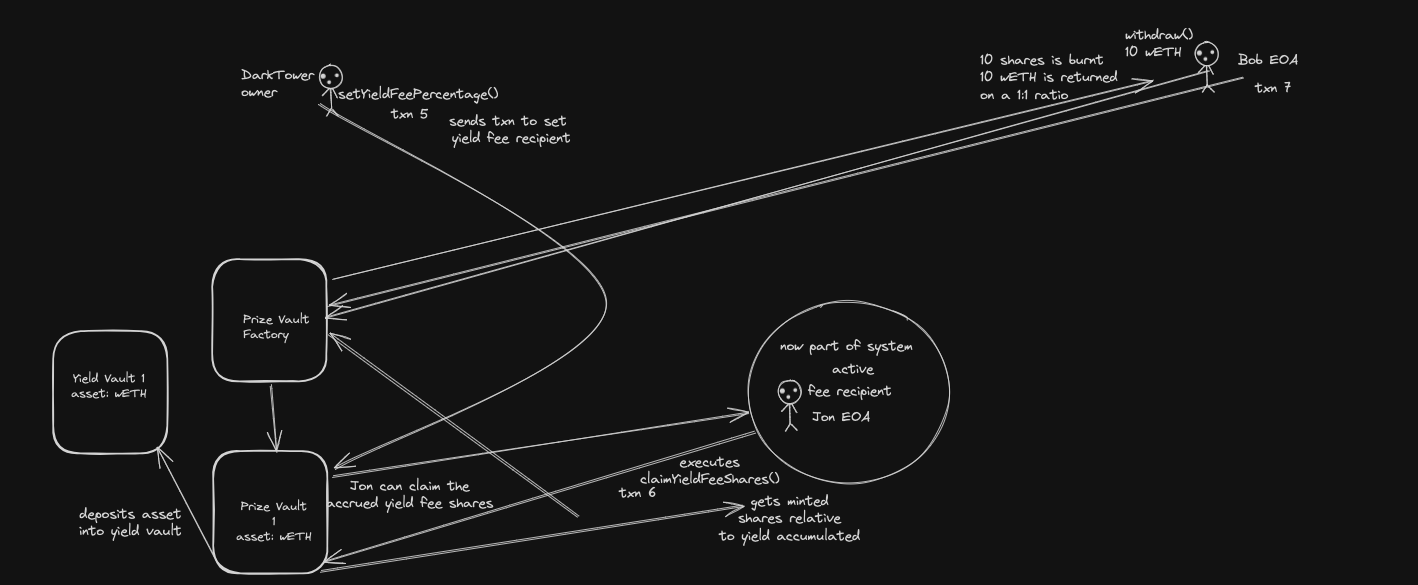

Exit point:

5. Weak spots and mitigations

-

Opt for full fee claims: With the current implementation of the

PrizeVault, the yield fee recipient when they claim yield fees get minted the amount of_sharesthey specified. The current implementation has a flaw in the sense that since the total accrued yield internal accounting variable specifically the_yieldFeeBalancegets wiped/reset/completely deducted, if the claimant claims 50 aUSDC whereas the accrued yield is 5000 aUSDC, the contract will wipe the state of the_yieldFeeBalancebeing 5000 aUSDC and only mint shares equivalent to 50 aUSDC thereby resulting in a loss of 4950 aUSDC for the protocol. Two ways to mitigate this: 1. Consider removing the_sharesto mint argument and mint the full amount instead in shares which automatically removes this flaw. 2. Consider deducting only the claimed_sharesfrom internal accounting rather than a complete wipe of it. -

Yield vaults with any share mint ratio above or below 1:1 will be incompatible: Any yield with a share to mint ratio other than 1:1 is incompatible with PoolTogether's PrizeVaults. Assuming there's a yield vault on Aave newly deployed requiring 10 USDC deposit for 1 share, since PoolTogether's share ratio is 1:1 e.g for a 1 USDC deposit, I get 1 share, when PoolTogether attempts to deposit my funds into the yieldVault, my share value will round down to .10% which is a loss of funds when I try to pull back my shares. The recommendation for this issue is to use the same setting as the yield vaults which can be achieved by querying the yield vaults directly for example during deposits, call the

yieldVault.previewDeposit()function rather than thepreviewDepositof thePrizeVaultcontract. This gives the user something to expect so they can already see via the interface that a deposit that doesn't round up whole to full shares will be rounded down hence leading to a loss during withdrawal. -

Vaults can be deployed to mimic other user's vault: Any vault being deployed in the

PrizeVaultFactorycan be frontrun to be deployed first thereby making two identical prize vaults that can fool users via social engineering. On convention, the malicious deployer will have theirs deployed first and if we simply go by time of deployment, it will seem as though the malicious deployer's vault was deployed first rather than the honest deployer's vault. However, there's an_ownerfield for deployed prize vaults that user can use to compare addresses of deployers to figure out which is legit and which is dishonest as vaults can share same name, symbol etc on convention. Our recommendation is to add in an argument that isn't supplied by the deployer such as a counter appended to each vault'sname&symbol. -

Sponsorship is open to the public: The idea of sponsorship in the traditional finance world is that anyone can do it. In the

PrizeVaultimplementation of sponsorship, anyone can do it at the moment which creates a scenario where users/depositors of a vault can run their chances of being picked as a winner during draws. The team should consider if this is the intended behavior as such actions can also be replicated by other users of a prize vault etc enforcing a race to outbid each other.

6. Conclusion

In conclusion, the PoolTogether's Prize vault v5 is a great concept in the sense they implemented a yield buffer feature to minimize rounding issues staple to almost all ERC4626 vaults. Their implementation differs a lot from Spectra's yield vaults in the sense that 1. Winners can claim prizes each draw. 2. The yield buffer feature for the dust strategy which mitigates rounding with the donated assets to the contract.

Time spent:

21 hours

#0 - c4-pre-sort

2024-03-13T03:15:44Z

raymondfam marked the issue as high quality report

#1 - c4-sponsor

2024-03-13T21:48:36Z

trmid (sponsor) acknowledged

#2 - c4-judge

2024-03-18T04:04:02Z

hansfriese marked the issue as grade-a